Last Updated on September 18, 2024 by Luke Feldbrugge

Welcome to the Housing Market Trends April 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends April Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

- The Fed’s cautious approach aims to keep inflation in check, with the CPI being closely monitored. Despite economic uncertainties, a “soft landing” is anticipated, avoiding a recession.

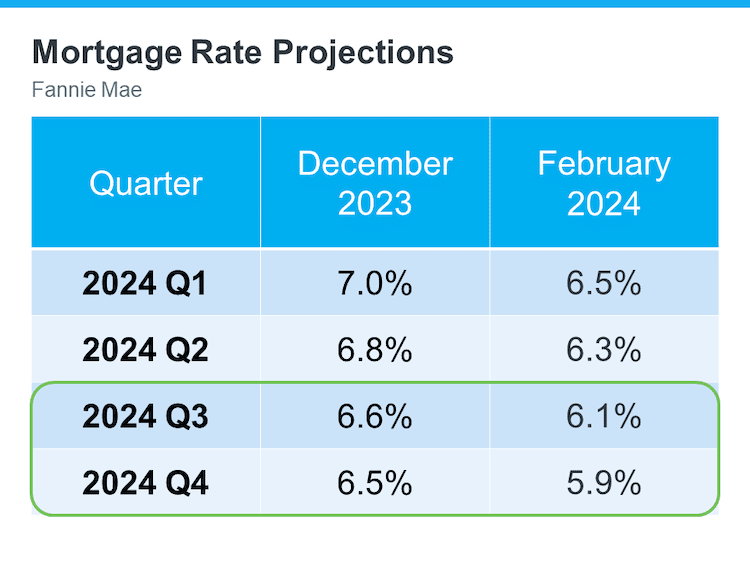

- Mortgage rates are expected to dip below 6% by year-end, giving homebuyers optimism.

- Housing inventory levels are increasing, providing more options for buyers.

- Home prices continue to rise, so it is still a sellers market.

- BONUS: Homes for Heroes offers resources and support to navigate these market trends, and provides an average savings of $3,000 after a hero buys or sells a home using their local specialists. Sign up today and a team member will contact you to discuss how to best serve your needs.

Inflation Affecting Interest Rates

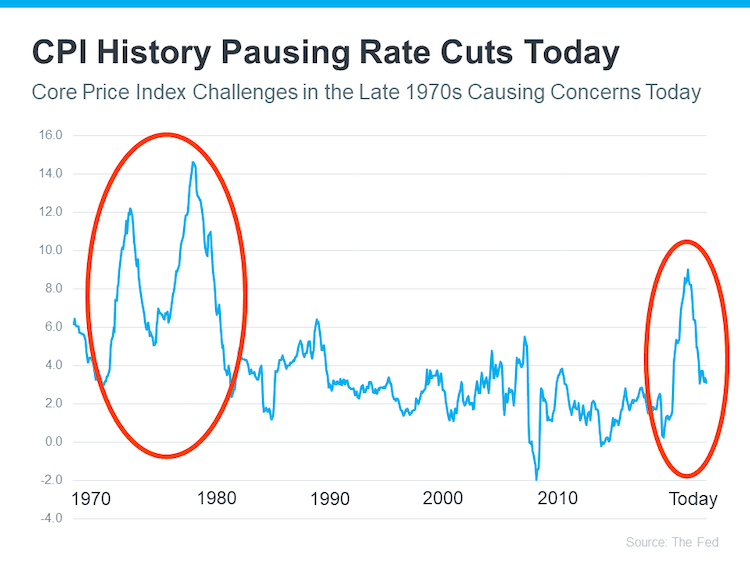

You will notice a couple spikes in the 1970s in the red oval on the left. What happened during this time was the Fed did their work to bring inflation down, but then they pulled back, cut rates too quickly and inflation spiked again before coming back down.

Many believe the Fed is attempting to avoid this circumstance from repeating given their recent policies. As shown in the red oval on the right, the Fed was able to work inflation down from 2022. But during their last session, they decided to hold rates instead of bringing them down. A big reason is they likely do not want to pull back too quickly and experience a repeat of the 70’s. Some have argued that holding rates too long could have similar adverse effects, but only time will tell.

Regardless, the Fed wants the CPI down to 2%. Unfortunately since June 2023, the inflation rate has been bouncing up and down around 3%, which is also likely contributing to their recent stance on rates.

Housing Market Trends April Mortgage Rates

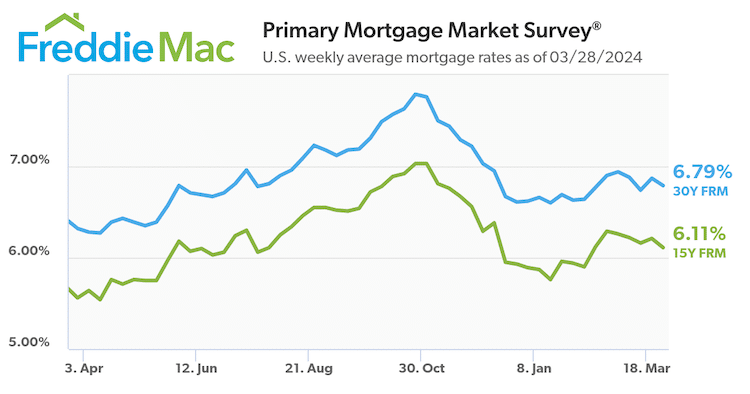

Currently (weekly average as of 3/28/2024) Freddie Mac’s Primary Mortgage Market Survey shows the 30-year fixed rate mortgage at 6.79%, which is slightly lower from the previous week.

Economy’s Impact on Housing Market Trends April

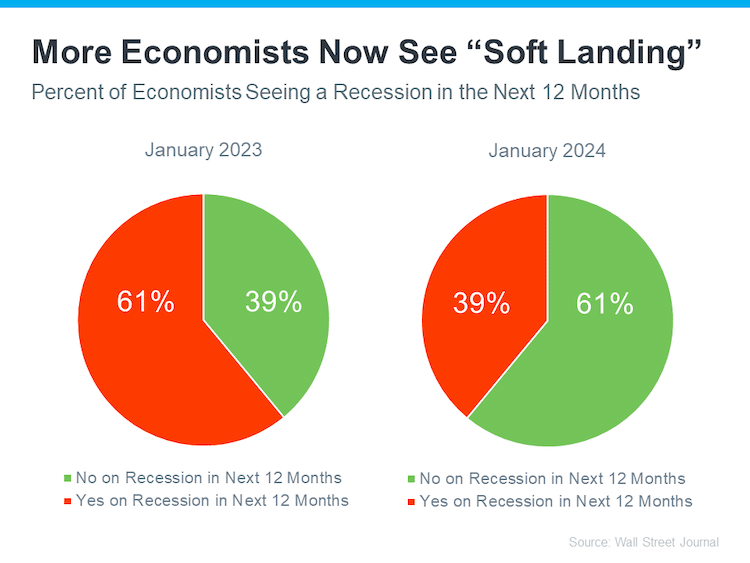

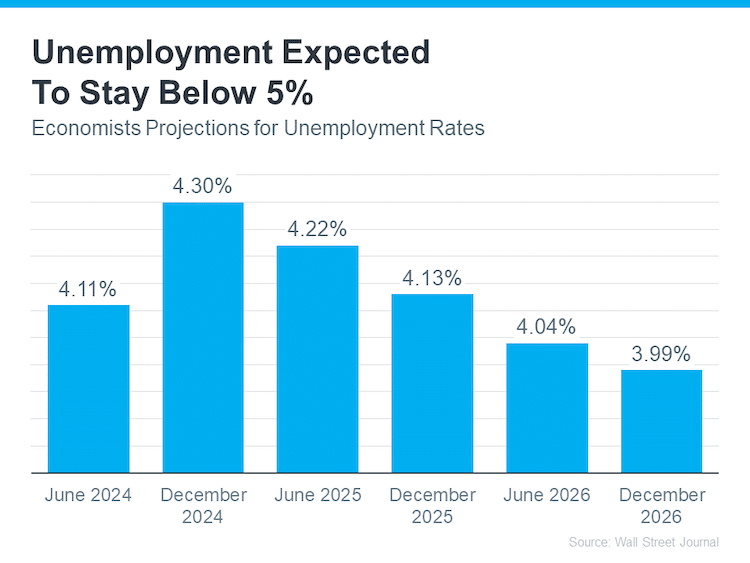

In January 2023, 61% of the economists surveyed believed the U.S. would experience a recession in the next 12 months. One year later, that opinion has changed, where now 61% of surveyed economists do NOT see the U.S. entering a recession. This is good news for all of us.

These positive outlooks from economists help us, the average U.S. consumer, feel better about where we are headed. Whether we have plans to buy or sell a home, or simply buy groceries for our family, these trends are moving in the right direction.

Housing Inventory Levels on the Rise

The National Association of REALTORS® reported on March 21, 2024 that the inventory of unsold existing homes increased 5.9% over February over January 2024. The lack of home inventory has been a challenging housing market trend for some time, so this additional inventory is a welcomed addition for home buyers.

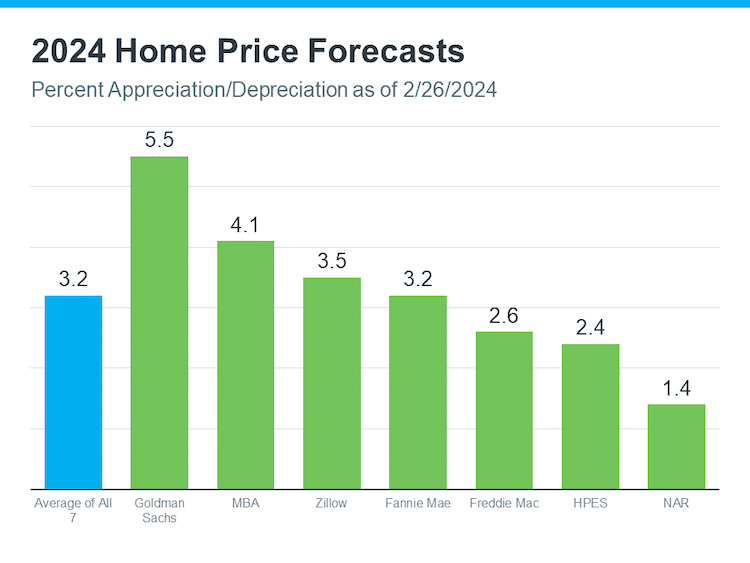

Unfortunately home prices are still climbing as NAR also reported the median existing home sales price rose 5.7% in February year over year. This is not great news for home buyers who may be struggling to find a home they can afford.

That said, many of the projections through the remainder of 2024 is that home prices will continue to increase gradually all year. So, for home sellers, you’re in a good spot if you’re thinking about putting your home on the market.

But, if you’re considering entering the market to purchase a home, sooner versus later may be the better option if the projected home price increases continue through the peak selling season.

Home Price Housing Market Trends

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after working with our specialists to close on a home or mortgage. We refer to these savings as Hero Rewards®, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

LIST OF SOURCES:

https://fred.stlouisfed.org/graph/?g=rocU#0

https://www.fanniemae.com/media/49866/display

https://www.fanniemae.com/media/50406/display

https://www.wsj.com/economy/economic-forecasting-survey-archive-11617814998

https://www.mba.org/news-and-research/forecasts-and-commentary/mortgage-finance-forecast-archives

https://www.zillow.com/research/2024-housing-predictions-33447/

https://www.fanniemae.com/media/50406/display

https://www.freddiemac.com/research/forecast/20240226-us-economy-defied-expectations

https://cdn.nar.realtor//sites/default/files/documents/forecast-q1-2024-us-economic-outlook-01-26-2024.pdf