Last Updated on September 18, 2024 by Luke Feldbrugge

Welcome to the Housing Market Trends July 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends July Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

- Home Prices and Affordability – Home prices continue to rise in 2024, driven by insufficient supply, impacting affordability for buyers.

- Home Inventory Levels – Inventory levels are increasing but remain below pre-pandemic levels, with new construction contributing significantly to the steady increase.

- Mortgage Rates – Mortgage rates have seen a recent decline to 6.87% in June 2024, offering some relief to home buyers, with a gradual decrease expected over the next year.

- Benefits of Homeownership – Here we offer 12 reasons why homeownership is beneficial; including building equity, tax advantages, stability, and investment potential.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes, with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to learn more and a member of the team will contact you.

Home Prices and Home Affordability

There are three main contributors to home affordability for a would-be home buyer in the U.S. Home affordability is primarily driven by current home prices, home inventory available for sale, and mortgage interest rates.

In 2024, the most positive trend has been the consistent increase in housing inventory over the past seven months.

Home prices continued to increase year-over-year in the first quarter 2024 which has not helped a struggling home buyer find an affordable home.

And with inflation still a concern in the first half of the year, the Fed also held on previous expectations of dropping interest rates. This contributed to mortgage interest rates bouncing between 7-8 percent in the second quarter of 2024.

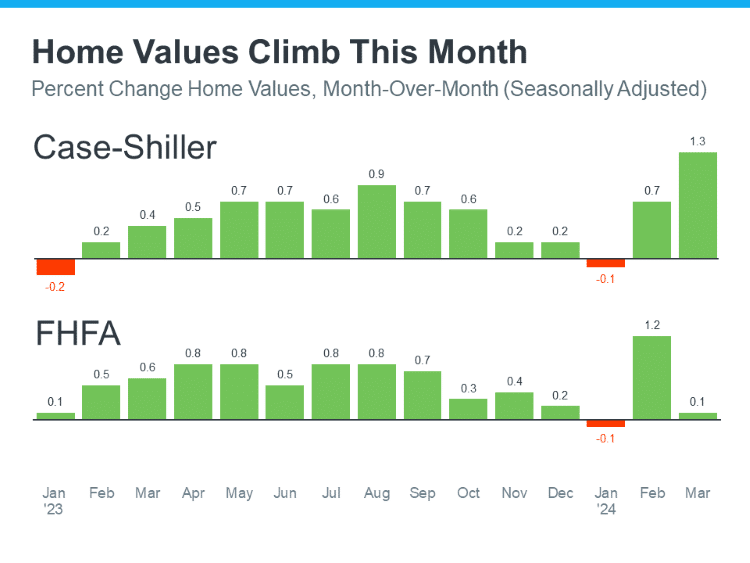

Home Prices Increased in 1st Quarter 2024

NAR came out and said, “In the current market, rising prices are the direct result of insufficient housing supply not meeting full demand.” – Lawrence Yun, Chief Economist, NAR (source: Inman, Keeping Current Matters)

Home buyers are finding it challenging to find a home they want at a price they can afford. Home sellers are enjoying the additional equity and home value these price increases offer, but there are recent headlines where sellers are pricing a little lower to increase the number of potential home buyer prospects for their house.

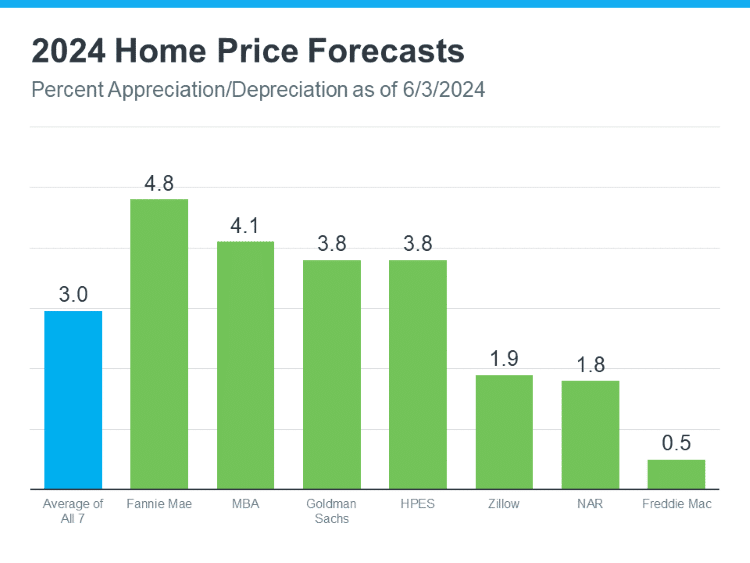

2024 Home Price Forecast – Increase of 3 Percent

At the beginning of 2024, the average home price appreciation forecast was around five percent, so you can see even the industry leaders are predicting home prices to experience less of an increase for the year.

This would be a win for home buyers struggling to find a home that fits their budget.

Home Inventory Levels Improving but Still Low

Home inventory, or listed homes for sale, have been slowly climbing year over year. But current inventory levels are well below industry averages.

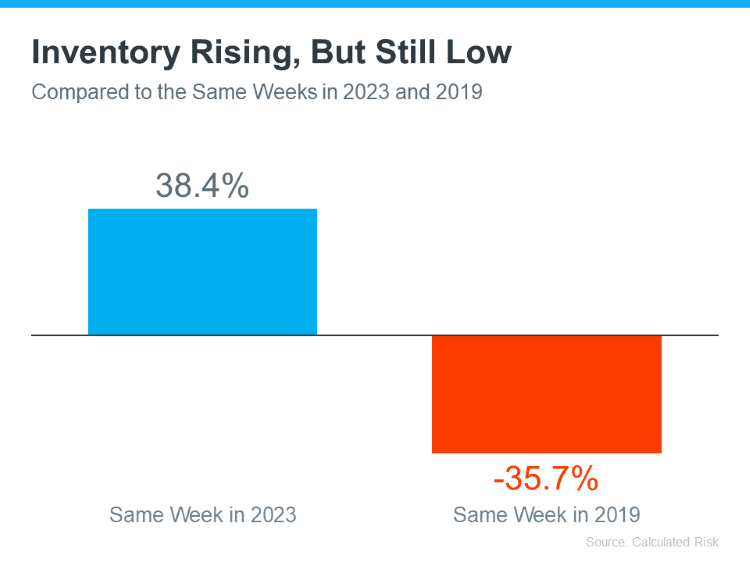

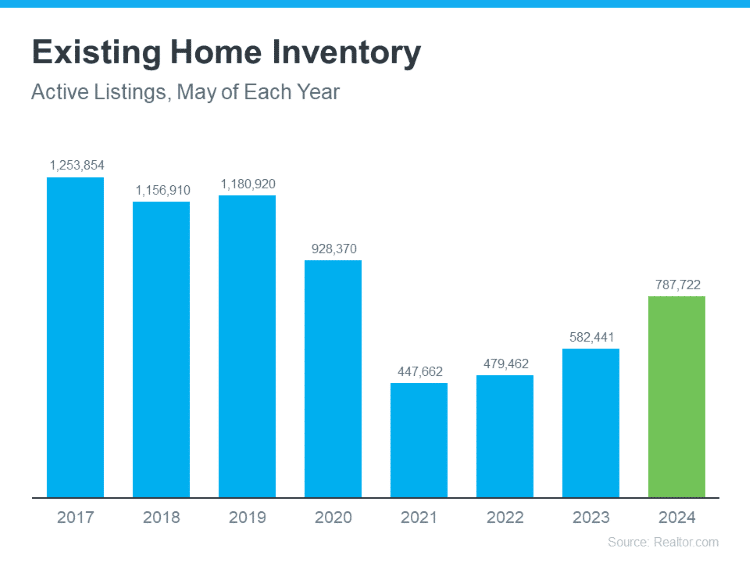

Inventory Levels Today Versus Pre-Pandemic

The first week of June 2024, versus the first week of June 2023, we saw a year-over-year increase in home inventory of over 38%. Great year-over-year increase!

However, when you look at the first week of June 2024 versus the first week of June 2019 (pre-pandemic), home inventory levels remain nearly 36% lower.

During the pandemic from 2020-2021, when mortgage interest rates were record lows and people were buying the available inventory quickly, home inventory experienced a dramatic decline.

So, we still have some inventory ground to make up, but it’s moving in the right direction.

Home Inventory Continues to Trend Upward

Check out the graph above. During the month of May, from 2017-2019, we see the typical home inventory levels for the U.S. residential real estate industry hovering around one million homes for sale.

In 2020 when the pandemic hit, and the country recovered from the initial shock of shutdowns and lifestyle adjustments, home buyers went into frenzy mode and began snatching up homes like crazy through 2021.

When the market began to cool down toward the end of 2021, we started to see annual increases in home inventory levels from 2022-2024, and it appears that trend is likely to continue.

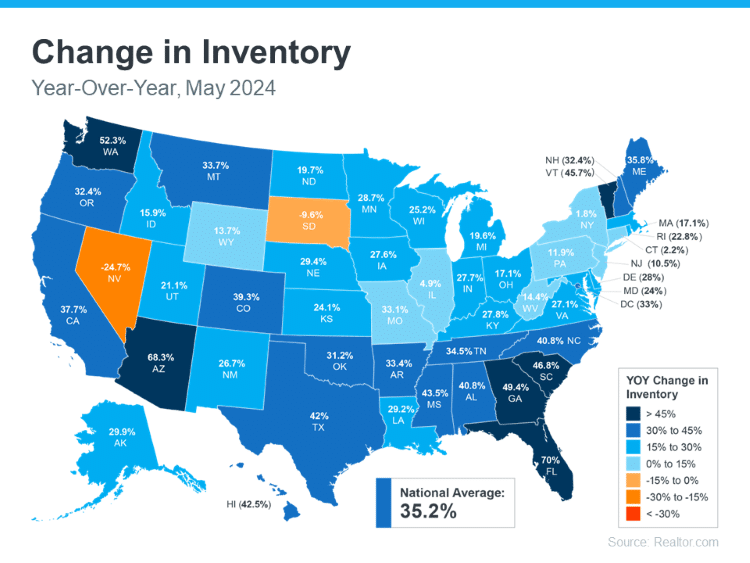

U.S. State Changes in Inventory YOY

Where you live will make a difference when it comes to home inventory levels. The graph above shows you year-over-year changes in inventory for the month of May 2024 and how each state differs. From Nevada and South Dakota showing declines, to the other 48 states showing an increase in home inventory levels, some as high as 70% like in Florida!

The U.S. average home inventory gains during the month of May, year-over-year, is a strong 35.2% national average increase.

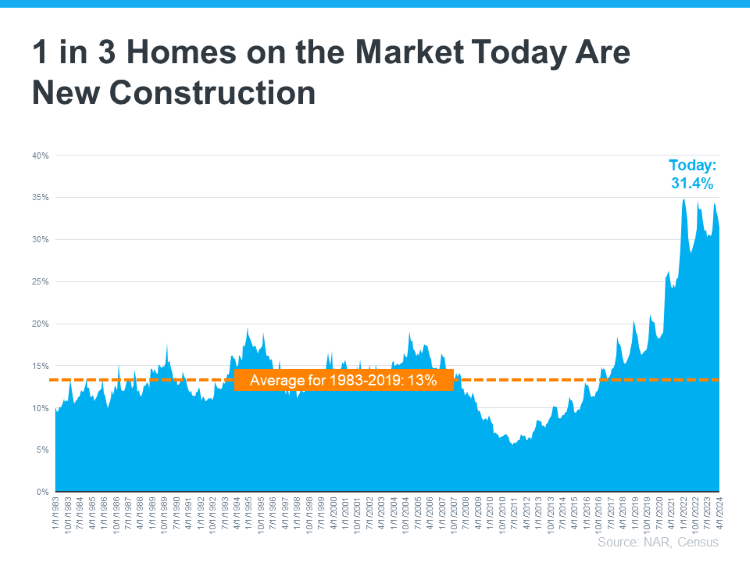

New Construction Shows Strong Growth Trend

A big contributor to the recent home inventory gains is due to the progress of new construction home builders actively adding new units.

More than one in three homes (>33%) available on the market as new inventory is a newly constructed home. That number is typically around 13%. Right now, this is a big help to relieving some of the need for home buyers who are shopping for a new home.

Mortgage Interest Rate Trend

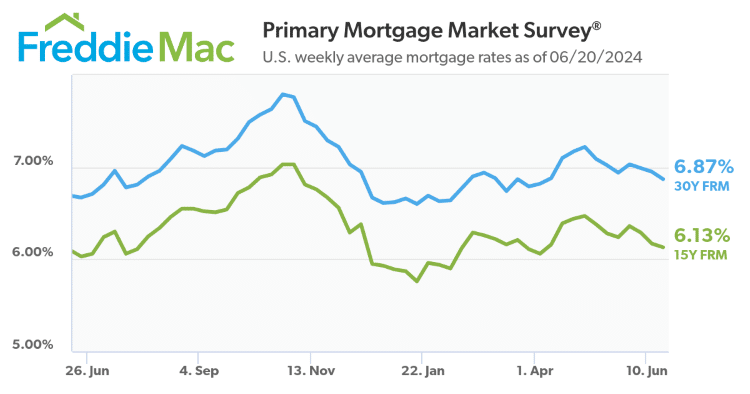

We can’t forget about mortgage rates. The good news is mortgage rates fell a bit in June and that’s great news for would-be home buyers. According to Freddie Mac’s Primary Mortgage Market Summary, and the U.S. weekly averages as of June 20, 2024 the 30-year fixed rate mortgage has come down from 7 percent in late May to 6.87%.

Consistent drops in mortgage rates are a welcomed shift from April and May for people looking to purchase a home during this peak time of the year. It definitely offers a little relief when it comes to home affordability.

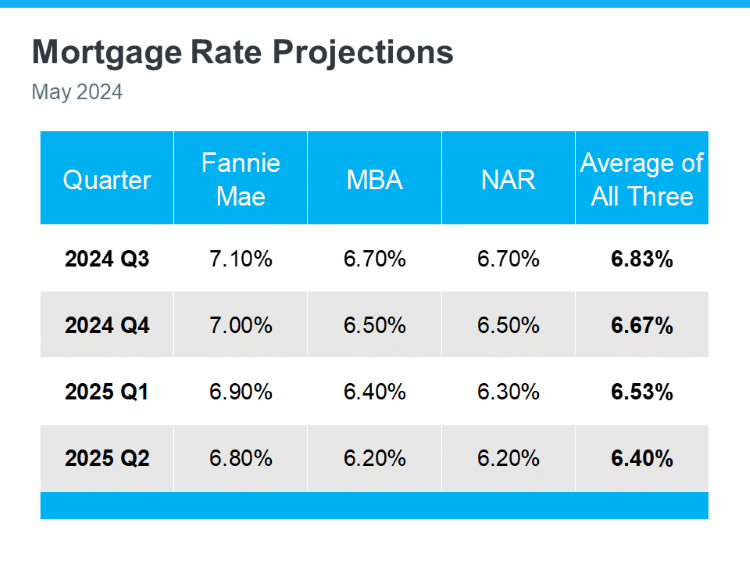

Next 12-Month Mortgage Rate Forecast

The Fed has taken a more cautious approach to reducing interest rates due to inflation and other economic indicators that caused the Fed slight concerns in the first half of 2024. That led to the Fed holding interest rates versus dropping interest rates.

This likely had a direct affect on mortgage interest rates bouncing up in May before settling back down a bit in June. As cooling inflation data became available for the Fed’s June meeting.

12 Benefits of Homeownership

With interest rates coming down a bit recently, and inventory continuing to ratchet slowly upward during the peak home selling season, we thought it might be a good idea to highlight some of the benefits of home ownership that may also be priorities for you in 2024.

- Enhanced Privacy and Security – When you own a home, you control who has access to your property, and you can customize security measures to provide a safe environment for you and your family.

- Ideal Environment for Raising a Family – Homeownership offers a stable and secure environment ideal for raising children. You can choose a neighborhood with good schools, parks, and other family-friendly amenities.

- Sense of Stability and Permanence – Knowing that you have a place to call your own provides peace of mind and helps you plan for the long term.

- Freedom to Personalize and Renovate – One of the joys of homeownership is the freedom to customize your space. Whether it’s painting walls, remodeling the kitchen, or landscaping the garden, you can tailor your home to reflect your personal style and preferences.

- Stronger Community Connections – Homeownership often leads to deeper involvement in your community. You’ll have more incentive to engage in local activities, get to know your neighbors, and contribute to making your community a better place.

- Building Home Equity – When you own a home, you build equity over time as you pay down your mortgage. This equity can serve as a valuable financial resource, whether for borrowing against in the future or as a nest egg for retirement.

- Tax Benefits – Home ownership comes with tax advantages. Typically you can deduct mortgage interest and property taxes from your taxable income.

- Improving Your Credit History – Paying your mortgage on time can help improve your credit history and boost your credit score. This can make it easier for you to obtain loans and favorable interest rates in the future.

- Predictable Monthly Housing Costs – Unlike rent, which can increase annually, a fixed-rate mortgage provides stable monthly payments. This predictability helps you manage your budget more effectively and avoid unexpected housing cost hikes.

- Investment Potential – A home can be a significant investment. Over time, property values tend to appreciate, offering the potential for a substantial return on your investment when you decide to sell.

- Independence from Landlords – Owning your home frees you from the constraints and rules set by landlords. You won’t have to worry about lease renewals, rent increases, or restrictions on pets and renovations.

- Opportunity for Rental Income – If your home has extra space, such as a basement apartment or a separate unit, you have the potential to earn rental income. This can help offset mortgage costs and provide additional financial security.

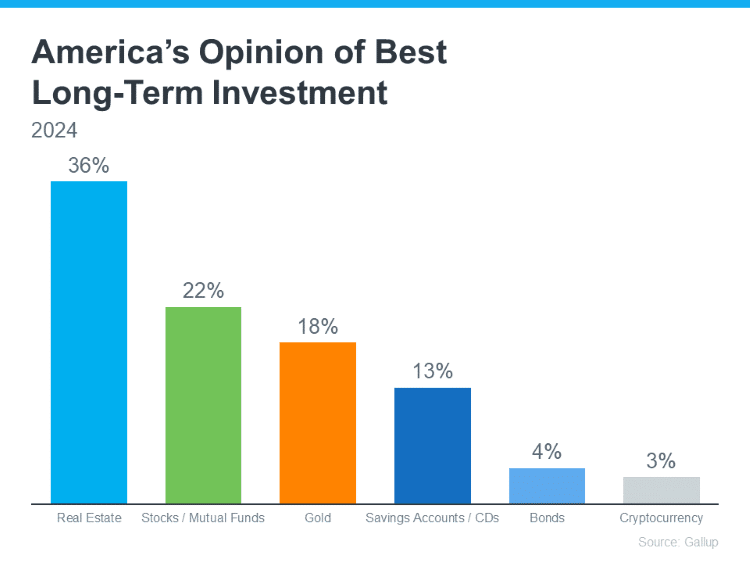

According to a survey conducted by Gallup, Americans chose homeownership as the best long-term investment over items such as; stock/mutual funds, gold, savings/CDs, bonds, and cryptocurrency.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. We refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

SOURCES:

https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/#news-research

https://www.fhfa.gov/data/hpi

https://x.com/NewsLambert/status/1797659853403672983

https://img03.en25.com/Web/MortgageBankersAssociation/%7B3a3cfcd7-a920-4329-8953-167a89666546%7D_Mortgage_Finance_Forecast_Apr_2024.pdf

https://img03.en25.com/Web/MortgageBankersAssociation/%7B3a3cfcd7-a920-4329-8953-167a89666546%7D_Mortgage_Finance_Forecast_Apr_2024.pdf

https://www.fanniemae.com/media/50986/display

https://www.freddiemac.com/research/forecast/20240418-economic-growth-moderated-labor-market-robust

https://www.nar.realtor/newsroom/pending-home-sales-ascended-3-4-in-march

https://www.calculatedriskblog.com/2024/06/housing-june-3rd-weekly-update.html

https://www.realtor.com/research/data/

https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

https://www.census.gov/construction/nrs/current/index.html

https://www.census.gov/housing/hvs/data/histtabs.html

https://news.gallup.com/poll/645107/stocks-gold-down-americans-best-investment-ratings.aspx

https://www.fanniemae.com/research-and-insights/forecast

https://www.mba.org/news-and-research/forecasts-and-commentary

https://www.nar.realtor/research-and-statistics

I’m looking to buy a home within a year.

Hi Desiree, That’s great! If you would like to speak with our local real estate and/or mortgage specialists (who will save you money if you purchase a home with us) about the home buying process, then simply sign up on our site and they will contact you to begin taking steps forward. All the best!