Last Updated on September 18, 2024 by Luke Feldbrugge

Welcome to the Housing Market Trends August 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends August Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends for August to help keep you informed as you determine what’s best for you.

- Home Prices and Affordability – Home prices are expected to rise by an average of 2.8% in 2024, with sellers seeing value increases, while buyers face continued affordability challenges.

- Home Inventory Levels – Inventory remains low despite gradual increases, keeping the market competitive for buyers and driving price increases.

- Mortgage Rates – Mortgage rates are projected to stay in the 6-7% range, impacting home affordability and causing buyers to carefully evaluate their financial options.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes, with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to learn more and a member of the team will contact you.

Housing Market Forecast for 2nd Half 2024

Home Price Forecasts

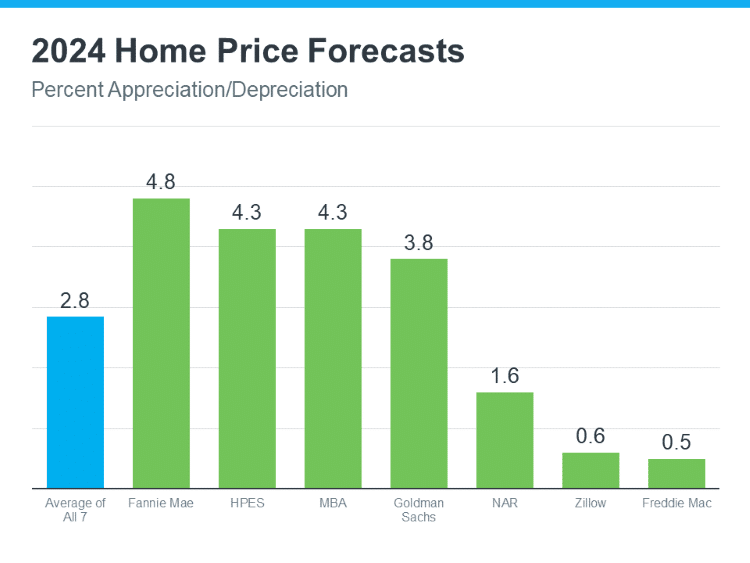

Nationally, if we average out these leading forecasters, it comes out to be 2.8% home price appreciation for 2024. You can see the difference between these seven forecasters, ranging from 0.5% – 4.8% home price appreciation. And, you may be seeing home prices going up at a higher or lower rate than the national average in your local market.

Key takeaways if you belong to one of these groups:

Potential Home Sellers

Your home will likely continue to increase in value in 2024. According to NAR (National Association of REALTORS®), existing home prices increased 4.1% in June.

Potential Home Buyers

If you are currently struggling to find an affordable home, continued price increases are not helping. The good news is the rate of increase has slowed dramatically versus the crazy price increases from 2020-2022, and the market home price appreciation/depreciation trend seems to have normalized. That said, when it comes to home prices for 2024, the consensus is they will increase. So if you’re sitting on the fence about buying a home right now, from an average home price standpoint, now may be a better time to start looking than later.

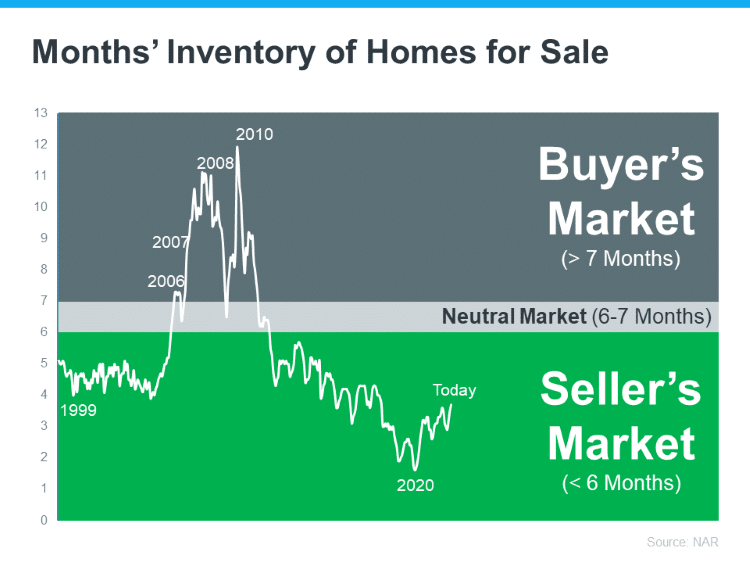

One of the biggest drivers of the continued price increases is the lack of home inventory for sale on the market. Again, this will depend on where you live. Nationally inventory is still considerably low even though it has been slowly creeping up each month in 2024.

Inventory of Homes for Sale

The low inventory of home sales is what continues to drive the current sellers market. If you look at the graph, you’ll notice that we’ve increased inventory since bottoming out during the pandemic in 2020-2021. But, we have a long way to go before we reach a neutral market.

Home buyers, there will likely not be a major event to cause home inventory to take a drastic jump up in the near future (knock on wood). That means you will continue to battle steady increases in home prices and limited homes for sale to consider for purchase. And, that also means competition with other home buyers will continue to be high as there are more buyers than sellers in the market.

Mortgage Rate Projections

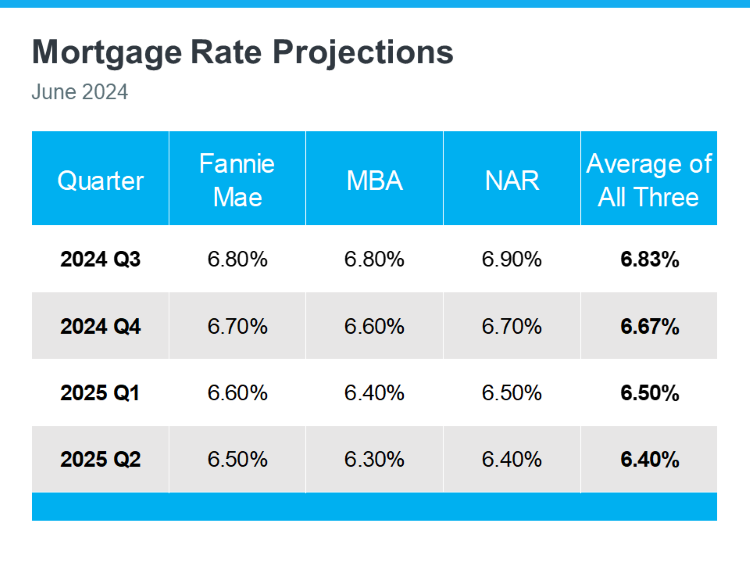

The graph above offers mortgage rate estimates for the next four quarters. Unlike earlier in the year, the estimated rates are projected to remain in the 6-7% range for all three market estimators.

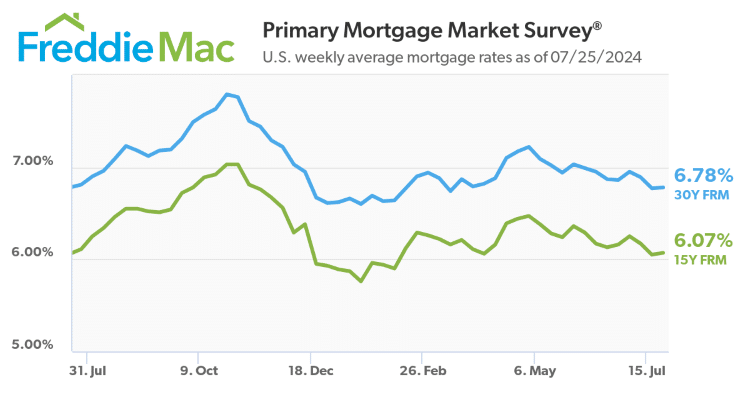

According to the Freddie Mac Primary Mortgage Market Survey and their U.S. weekly averages as of July 25, 2024, the 30 year fixed rate mortgage interest rate was 6.78%. The 15 year fixed rate mortgage interest rate was 6.07%.

On July 31, 2024 the Federal Reserve announced that it would hold on making any moves on its key interest rate, and instead Jerome Powell is looking to September for a potential key rate decrease.

This is unfortunate news for home buyers as mortgage rates are a big contributor to how much home you can afford. With rates remaining in the high 6% range, and no federal rate cut to offer some relief, it may remain challenging for would-be home buyers to enter the market or current home shoppers to find a home they can afford.

Can the Election Affect the Housing Market?

The election can affect consumer perception. That is how an election can directly affect the housing market. An election year causes people to question the current state of the country and what the potential winner’s party will bring to the economy and the housing market. Some people will choose to wait on making any major purchase decisions until they feel more confident and comfortable about where the country is headed under the election winner.

If you have ever been a professional firefighter, EMS, law enforcement, military or veteran, healthcare professional or teacher, remember to consider working with a Homes for Heroes real estate and/or mortgage specialist to save significant money when you purchase a new home or sell your current home.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. We refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

SOURCES:

https://x.com/NewsLambert/status/1797659853403672983https://img03.en25.com/Web/MortgageBankersAssociation/%7B7e604828-7f2c-4117-a76f-fe8f3e6bdafc%7D_Mortgage_Finance_Forecast_May_2024.pdfhttps://www.zillow.com/research/home-value-sales-forecast-33822/https://www.freddiemac.com/research/forecast/20240418-economic-growth-moderated-labor-market-robusthttps://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-saleshttps://cdn.nar.realtor/sites/default/files/documents/ehs-05-2024-overview-2024-06-21.pdfhttps://www.fanniemae.com/media/51616/displayhttps://img03.en25.com/Web/MortgageBankersAssociation/%7Bb6d58e6f-e78a-4fd4-bef9-65cb74bf18cc%7D_Mortgage_Finance_Forecast_Jun_2024.pdfhttps://cdn.nar.realtor/sites/default/files/documents/forecast-q2-2024-us-economic-outlook-06-27-2024.pdf