Last Updated on September 18, 2024 by Luke Feldbrugge

Welcome to the Housing Market Trends January 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends January 2024

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

- Most industry experts are offering an optimistic outlook for 2024!

- Number of homes for sale is still low and not yet meeting buyer demand

- Home affordability remains challenging, but home buyers are still active

Home Prices Projected to Increase Slightly and Stabilize

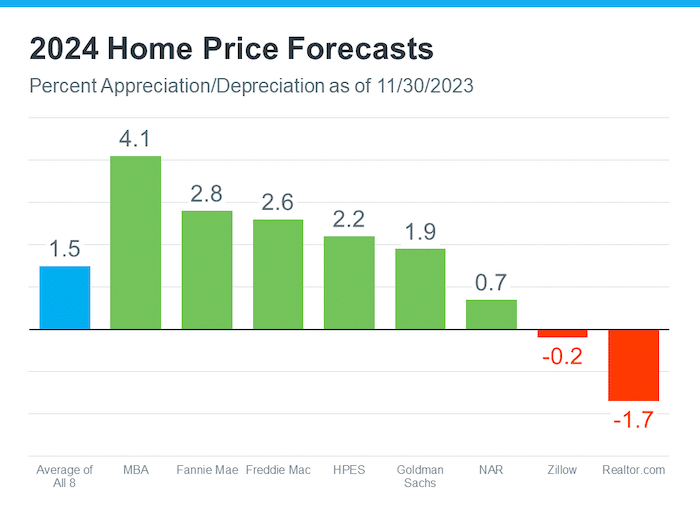

Based on eight industry leading organization’s forecasts, the average home will increase (appreciate) in price 1.5 percent in 2024.

This is great news for current homeowners who may be thinking about selling their home in 2024. Based on this forecast their home will avoid a decrease in home value in 2024.

For home buyers, 1.5 percent is not terrible news. Due to the affordability issue faced by many home buyers in the market, or those thinking about entering the market, knowing that the projected home price will remain fairly flat and/or increase slightly is a good thing considering the abnormal price jump over the past two years.

That said, as the housing market and the U.S. economy continue to slowly improve, home buyers really need three things to change to help them afford a new home:

- They need home price increases to slow down (sounds like that’s happening as they begin to stabilize)

- Wages to increase and the cost of consumer good to decrease (according the the November 2023 Consumer Price Index, consumer prices are up 3.1% versus one year ago).

- And, mortgage rates need to moderate further

Market Could See 20 Percent Increase in Home Sales

Based on the three forecasts shown, the combined existing and new home sales average total (in millions) as of November 30, 2023 is estimated to be 5.1 million in the U.S. in 2024. That would roughly be a 20 percent increase over 2023 total home sales.

Will Mortgage Rates Decrease in 2024?

For the week ending Thursday January 4, 2024 according to the Freddie Mac’s Primary Mortgage Market Survey reflects an average 6.62% interest rate on a 30-year fixed rate mortgage. Two months ago on October 26th, the 30-year fixed mortgage rate was 7.79% according to the same survey. That means the average 30-fixed mortgage rate dropped 1.17 percentage points in two months!

This is outstanding news for home buyers because it helps to make a home more affordable even if prices are slightly higher in 2024. If this drop in mortgage rates continues, more and more home buyers will enter the housing market and begin their search for a home.

The volatility of mortgage interest rates has been an ongoing issue in the market and for potential home buyers. But, with the Fed easing up on interest rate hikes and other key factors coming into play, experts tend to agree interest rates should continue to decline in 2024.

Inventory: New Listings Seem to be Stabilizing

First, the number of homes for sale is still far below where the market was before the pandemic hit in 2020.

That said, if you want some positive news, the black line shows the monthly count of new house listings entering the market in 2023. The dotted line is what’s really interesting. That reflects the normal seasonality and sales decline that is typically seen at the end of the year. If you look at the other years, pre-2023, you see the typical decline in the back half of the year.

But, we didn’t see that same trend in 2023, and it appears more sellers have decided they do not want to wait to sell their home, and more people who are thinking about selling their home are starting to put their home on the market. And, that will help the hungry home buyers find a new home.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; buy, sell and refinance their home or mortgage. But if you work with their local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. They refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up they will contact you to ask a few questions and help you determine the appropriate next steps for you. When you’re ready, they will connect you with their local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and their local specialists thank community heroes, like you, for your dedicated and valuable service.

LIST OF SOURCES:

https://www.zillow.com/research/2024-housing-predictions-33447/https://www.realtor.com/research/2024-national-housing-forecast/

https://twitter.com/NewsLambert/status/1730642488346472787

https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-nov-2023.pdf?sfvrsn=acef26ff_1

https://pulsenomics.com/surveys/

https://www.fanniemae.com/media/49661/display

https://www.freddiemac.com/research/forecast/20231121-economic-growth-remained-strong-in-q3

https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-nov-2023.pdf?sfvrsn=acef26ff_1

https://www.fanniemae.com/media/49661/display

https://www.realtor.com/research/data/

https://www.freddiemac.com/pmms