Welcome to the Housing Market Trends December 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends December Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends for December to help keep you informed as you determine what’s best for you.

- Mortgage Rate Trends – The Fed cut rate again but mortgage rates have slightly increased. Projections indicate a gradual decline over the next 6–9 months, though uncertainty remains due to inflation and economic conditions.

- Home Inventory Trends – The inventory of unsold existing homes rose 0.7% in October 2024, continuing this year’s upward trend, but the persistent shortage still impacts home prices.

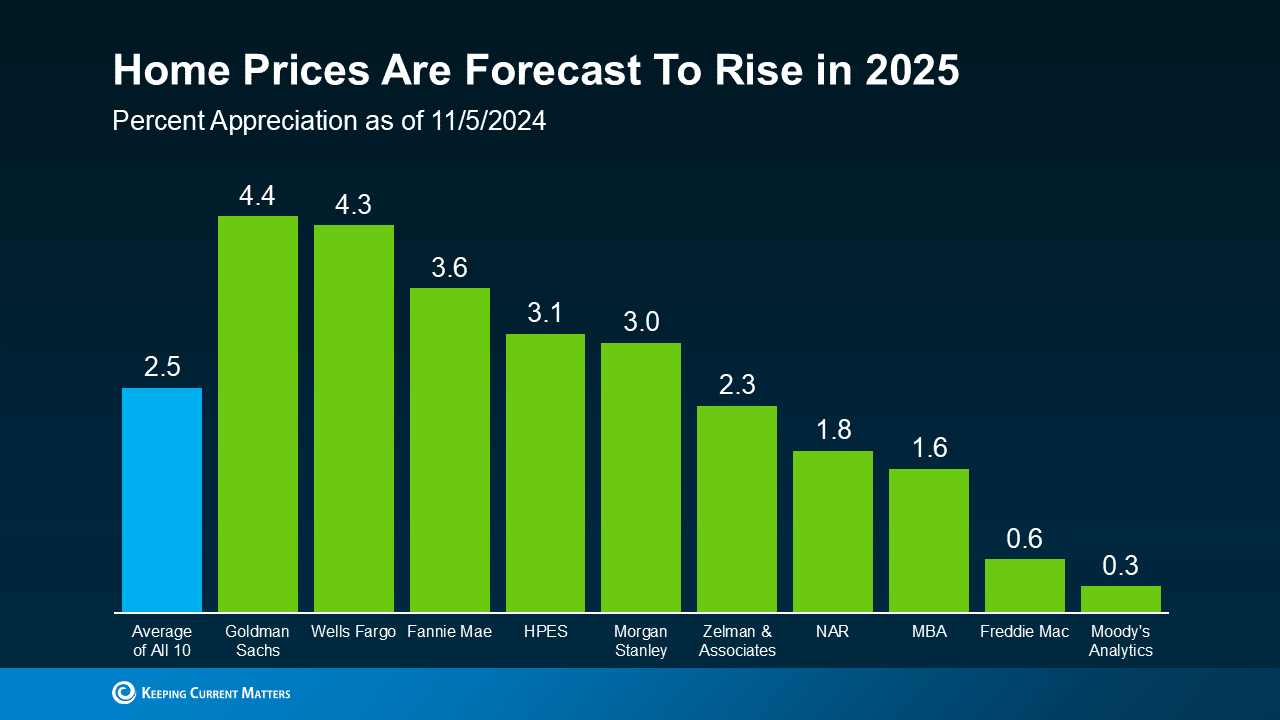

- Home Pricing Trends – Home prices continue to rise, with a 4% year-over-year increase in October 2024 and a forecasted 2.5% average increase for 2025, and affordability is still an issue due to low inventory.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes, with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to learn more and a member of the team will contact you.

Housing Market Trends December 2024 in Detail

Mortgage Rate Trends

On November 7, 2024 the Fed reduced the federal funds target rate by another 0.25%, but it has not affected mortgage rates too much since.

The Fed dropped the federal funds target rate another 25 basis points to a range of 4.50 – 4.75%. This is helpful news for the economic outlook and future consumer buying power, so hopefully it will encourage some spending as we enter the holiday season. But, we have not seen a decline in mortgage rates since the basis point reduction.

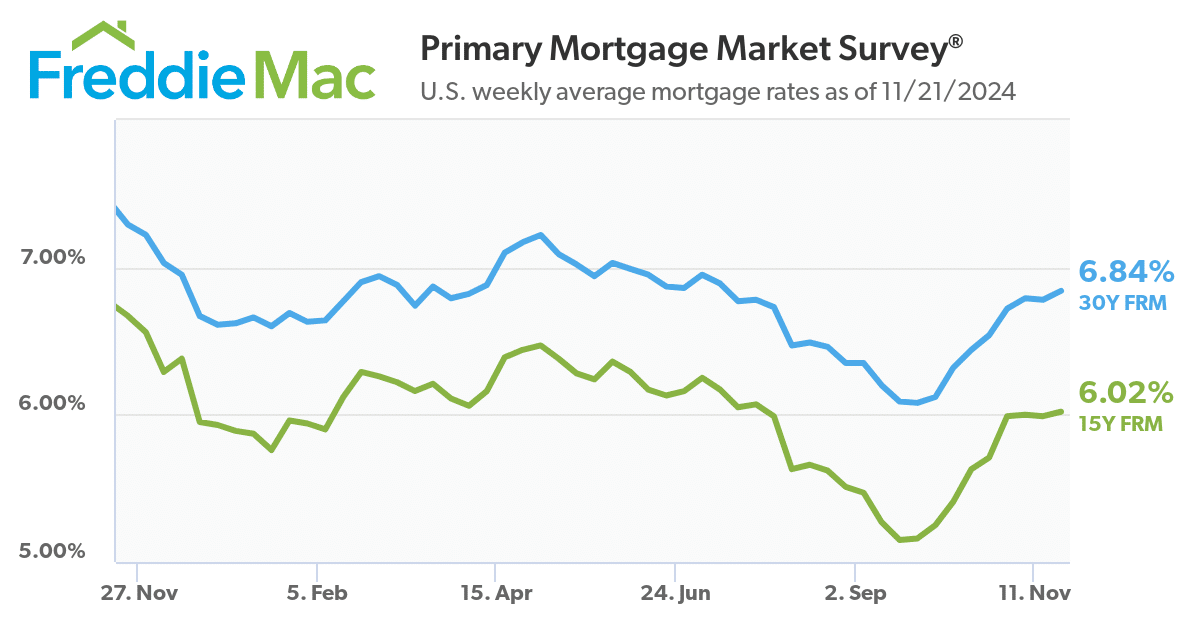

Freddie Mac’s Primary Mortgage Market Survey trend line graph above shows interest rates over the past twelve months for both the 30-year and 15-year fixed rate mortgage, and since the most recent Fed rate reduction on November 7th, rates have increased slightly from 6.79% to 6.84% for the 30-year fixed rate mortgage. The 15-year rate also increased slightly from 5.99% to 6.02%.

The increase in mortgage interest rates over the past eight weeks, runs counter to what potential home buyers were hoping to see, following the rate reductions in September and now in November by the Fed. However, many industry experts have said most of the mortgage rate reduction happened pre-September’s Fed announcement in anticipation of a rate reduction happening.

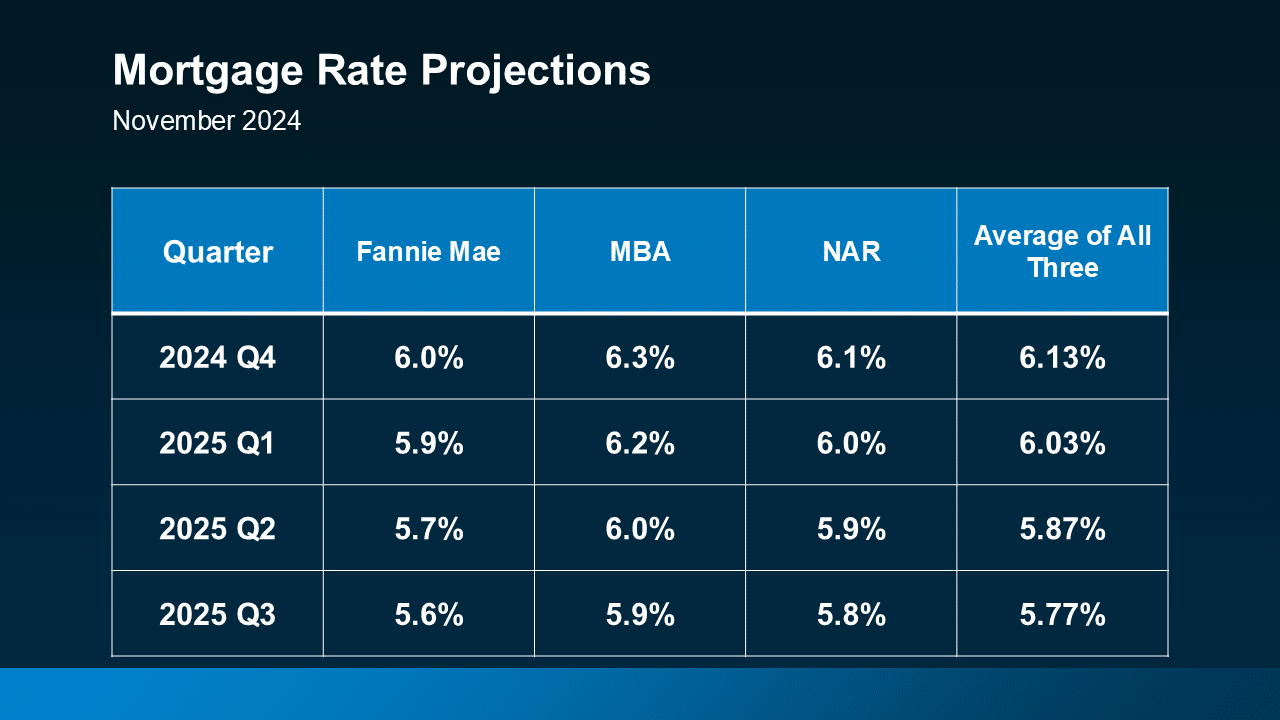

The mortgage interest rate trend is projected to decline over the next 6-9 months, but it is anticipated to be a much more gradual decline. The table above shows an average mortgage rate projection for Q4 2024 of 6.13%, and a trend that gradually declines, eventually landing on an average mortgage rate of 5.77% in Q3 2025.

There will be some ups and downs during this time frame, but the gradual decline in mortgage rates is what potential buyers need, especially given recent increases in mortgage rates.

These are early November 2024 projections and there are some discussions currently happening on how some of these mortgage leaders may increase their mortgage rate projections for 2025.

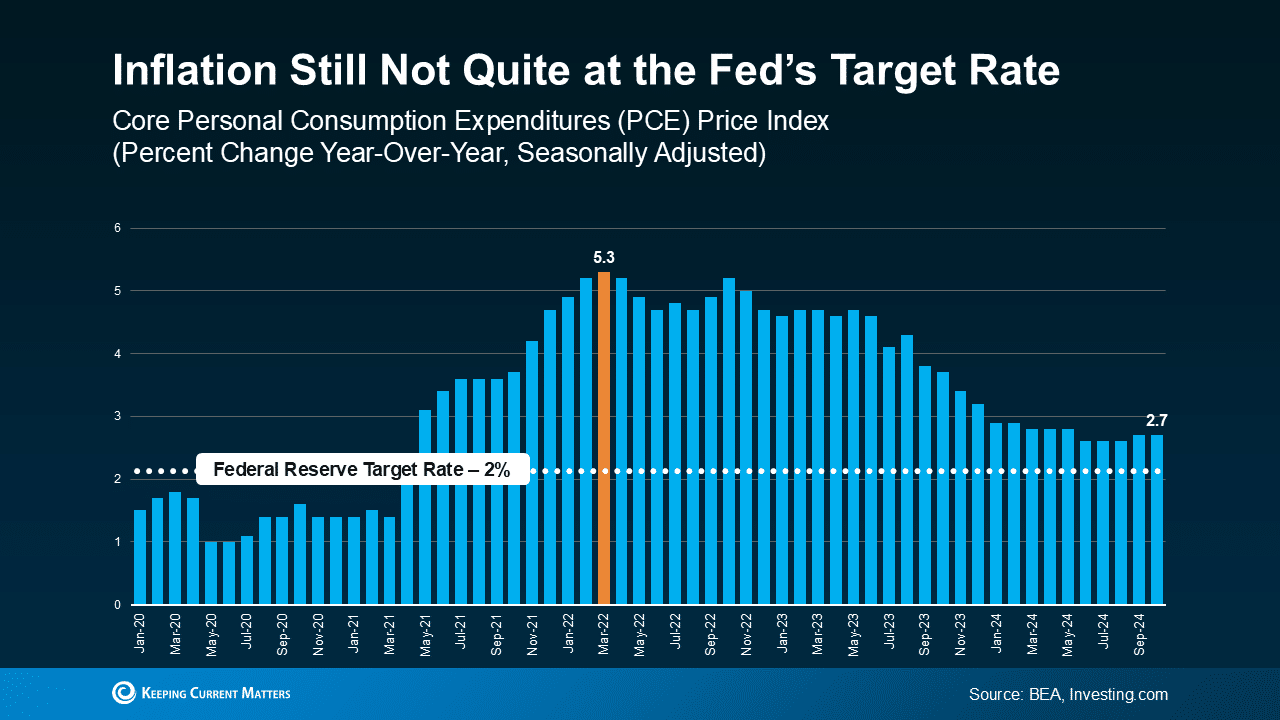

As you can see above, inflation has not met the Fed’s target rate of 2%.

However, there’s still a chance the additional rate reduction of 25 bps by the Fed, and having the presidential election behind us, will help spur interest rates to start moving down again before the end of 2024.

If you are thinking about getting into the housing market, remember to consider working with Homes for Heroes real estate and mortgage specialists to help you through the process. We will save local heroes (firefighters, EMS, law enforcement, military and veterans, healthcare professionals, and teachers) significant money when you close on a home with our specialists. On average you can save $3,000 if you buy a home, and $6,000 if you buy AND sell a home.

Sign up today and a member of our team will reach out to answer your questions, and to find out how we can best serve you.

Home Inventory Trends

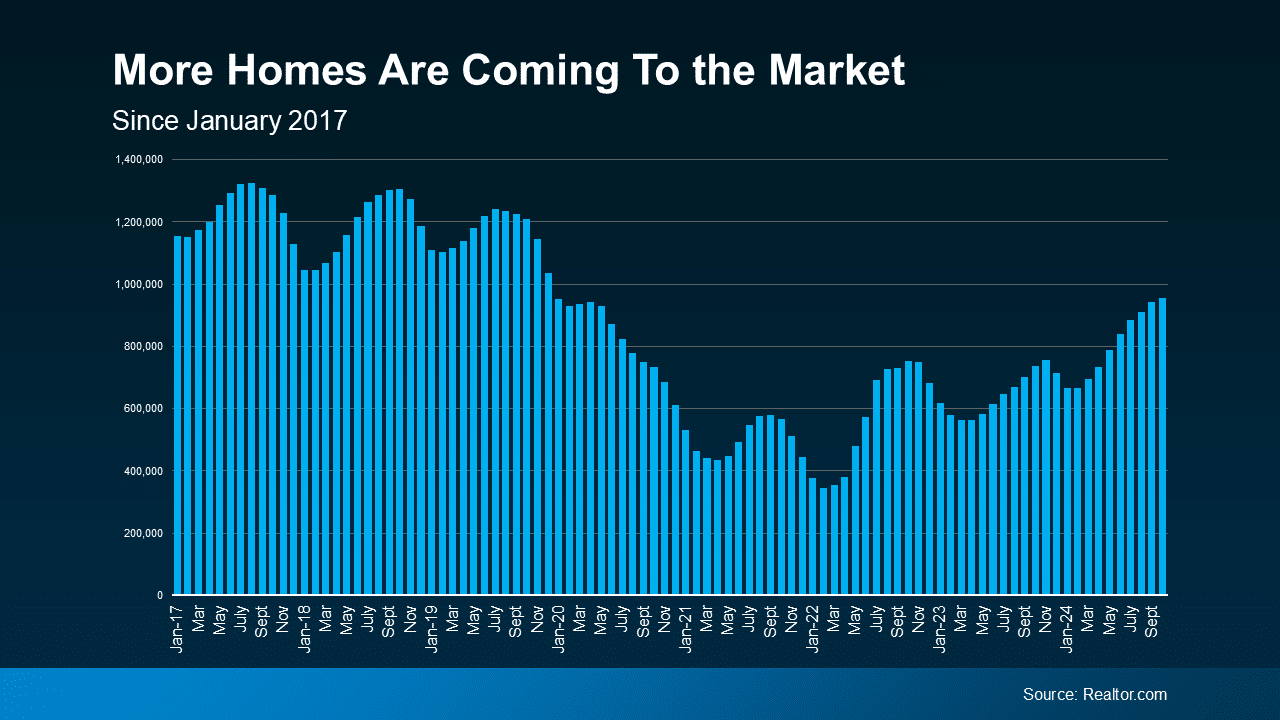

The National Association of Realtors (NAR) reported the inventory of unsold existing homes increased slightly 0.7% in October 2024, versus the previous month of September. But, it was up dramatically versus October last year, continuing the trend of increasing home inventory.

More inventory of existing homes versus the previous month is good news, but there’s a long way to go, and the lack of inventory continues to affect home prices.

Home Pricing Trends

Home prices continue to appreciate. The bar chart above reflects 2025 home price forecasts from ten different industry leaders as of 11/5/2024, forecasting an average home price increase of 2.5% in 2025.

The National Association of Realtors (NAR) reported that national home prices increased 4.0% in October 2024, versus YOY October 2023. And, that marks the 16th consecutive month of year-over-year national median existing home sales price gains.

This is great news for homeowners worried about loss of recent equity gains for their current home, and also for would-be home sellers who want to capitalize on the recent price increase to leverage that gained equity for other financial priorities.

However, this is not great news for home buyers who are still struggling to find affordable housing options in today’s market.

That said, it is good to know that leading market experts are expecting the rate of home price increases to slow a bit going into 2025. But, low inventory is still causing prices to rise.

If you’re deciding whether to enter the market to purchase a home and would like to better understand your current local housing market trends, sign up to speak with a member of the Homes for Heroes team. They will answer your initial questions, and when you’re ready, connect you with our local real estate and/or mortgage specialist to begin the process.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. We refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.