Welcome to the Housing Market Trends February 2025 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends February Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends for February to help determine what’s best for you as you consider your housing situation:

- Mortgage Rate Trends – Mortgage rates are expected to decline gradually throughout 2025, with projections averaging around 6.36% for a 30-year fixed-rate mortgage.

- Home Inventory Trends – Home inventory is forecasted to increase in 2025 by 11.7% year-over-year, providing more options for buyers.

- Home Pricing Trends – Home prices will continue to rise, but at a slower pace, with an average forecasted increase of 2.9% in 2025.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes, with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to learn more and a one of our local experts will contact.

Housing Market Trends February 2025 in Detail

Mortgage Interest Rates

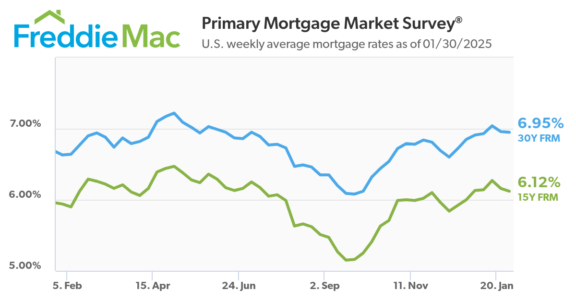

Freddie Mac’s Primary Mortgage Market Survey weekly trend line graph above shows the weekly interest rate over the past twelve months for both the 30-year and 15-year fixed rate mortgage, and last Thursday January 30, 2025 the 30-year fixed was at 6.95%. The 15-year rate came in at 6.12%.

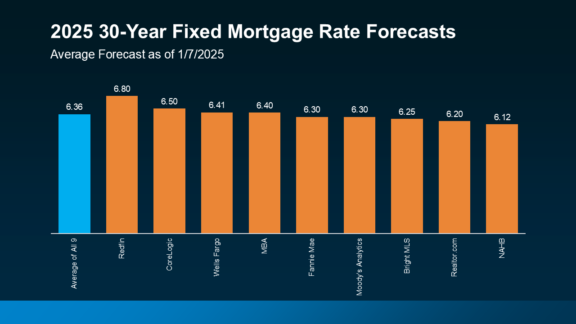

As of January 7, 2025 these nine industry leaders project that we will reach a low-6 percent mortgage rates on a 30-year fixed rate mortgage by the end of 2025. Is there a chance the market will get under 6 percent? Sure there’s a chance, but it’s not projected by these industry leaders today.

The bar graph shows an average mortgage rate projection for 2025 of 6.36%. As of January 31, per Optimal Blue’s daily mortgage rate estimates, the 30-year conforming mortgage rate closed out January at 6.843%.

That said, the mortgage interest rate trend is projected to decline throughout 2025. However, it will be more of a gradual decline throughout the year.

If you are thinking about getting into the housing market, remember to consider working with Homes for Heroes real estate and mortgage specialists to help you through the process. We help local heroes (firefighters, EMS, law enforcement, military and veterans, healthcare professionals, and teachers) save significant money when they close on a home with our specialists. On average, one of our heroes can save $3,000 if they buy a home, and $6,000 if you buy AND sell a home.

Sign up today to speak with one of our local specialists in your area. They will reach out to answer your questions, and to find out how we can best serve you.

Home Inventory Trends

The National Association of Realtors (NAR) reported the inventory of unsold existing homes decreased 13.5% in December 2024 versus the previous month of November 2024.

However, that is due in part to sales increasing 9.3% from one year ago. This increase is the largest year-over-year gain since June 2021. Does this indicate maybe some buyers can’t wait for inventory to loosen, prices to drop, or interest rates to get lower? Maybe 2025 is the year for you to find that new home.

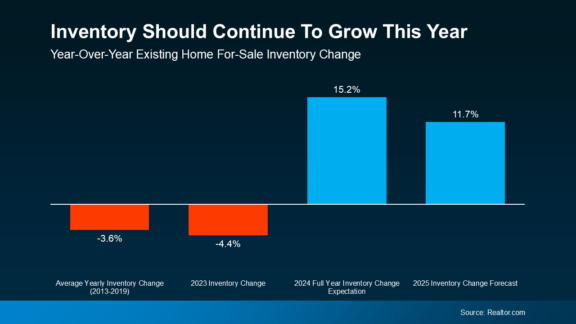

According to Realtor.com inventory should continue to grow this year. The graph above shows the average yearly inventory change from 2013-2019 was a decrease of -3.6%, and in 2023 there was a decrease of 4.4% inventory change.

The full year inventory change for 2024 is expected to be an increase of 15.2%, and the year-over-year existing home for-sale inventory change forecast in 2025 is an increase of 11.7% versus 2024. This projected increase in inventory is great news for future home buyers.

2025 Home Pricing Trends

Home prices continue to appreciate, but at a much slower and healthier pace. This will depend upon the housing market where you live, but as you can see, the bar chart above reflects 2025 home price forecasts from twenty-one different industry leaders as of January 7, 2025 and they are forecasting an average home price increase of 2.9% in 2025.

The National Association of Realtors (NAR) reported that national home prices increased 6% in December 2024, versus YOY December 2023. And, that marks the 18th consecutive month of year-over-year national median existing home sales price gains.

This is great news for homeowners worried about loss of recent equity gains for their current home.

It’s also good news for would-be home sellers who want to capitalize on the recent home price increases to leverage that gained equity for other financial priorities.

However, this is not great news for home buyers who are still struggling to find affordable housing options in today’s market.

That said, it is good to know that leading market experts are expecting the rate of home price appreciation to slow a bit throughout 2025. But, the market’s low inventory issue is still causing prices to rise.

If you’re deciding whether to enter the market to purchase a home and would like to better understand your current local housing market trends, sign up to speak with one of our local experts. They will answer your questions.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare professionals and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the Homes for Heroes team. There’s no obligation. After you sign up, our local real estate and/or mortgage experts will contact you to answer your questions. If you choose to work with them, they will save you significant money when you close on your home.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.