Welcome to the Housing Market Trends June 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends June Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

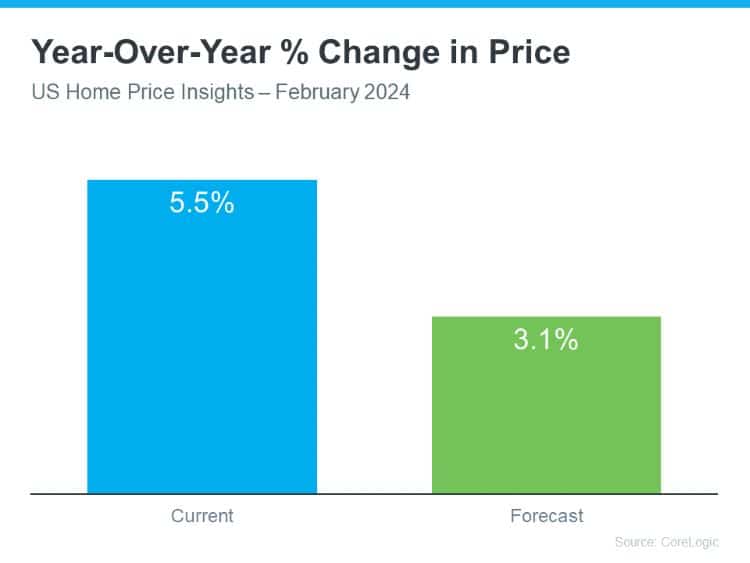

- Home Affordability – Home prices continue to increase, but at a slower rate. Builders are helping the affordability issue by increasing the availability of smaller, more affordable homes.

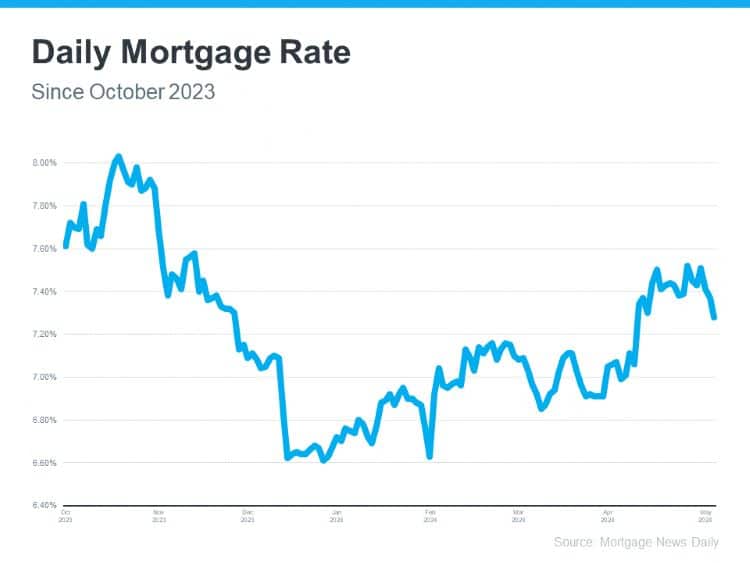

- Interest Rates – The 30-year fixed mortgage rates have been a roller coaster of ups and downs, influenced by the Federal Reserve’s decision to hold rates due to rising inflation.

- Home Buyers and Sellers – Both need a solid competitive strategy to maximize the return on their investment into buying or selling a home.

- Homes for Heroes Savings – Offers home buying and selling real estate and mortgage professionals in your market who provide an average savings of $3,000 per transaction. Sign up to learn more.

Home Affordability – Builders Providing Solutions

Although home price increases have slowed down this year, and the forecast for 2024 is around 3%, home affordability remains a big obstacle for many home buyers. Although home price increases have slowed down this year, according to the National Association of REALTORS® (NAR), in their April existing home sales report, the median existing home sales price grew 5.7% from April 2023 to $407,600. This marks the tenth consecutive month of year-over-year price gains.

Great news for sellers, not so great news for buyers.

Due to economic conditions such as inflation hitting the average U.S. citizen pretty hard in 2023 and the 1st half of 2024, plus high interest rates and low home inventory, things are challenging for home buyers right now.

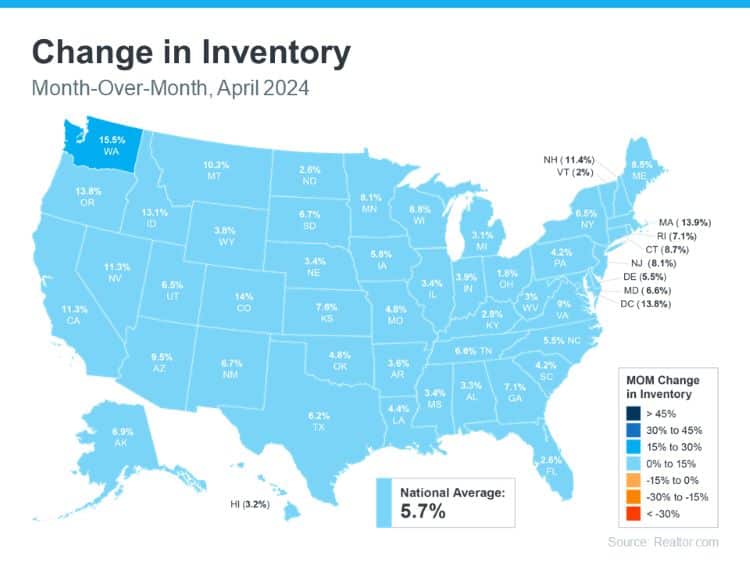

Yes, inventory was up in every U.S. state month-over-month in April 2024, with a national average of 5.7%. But, inventory levels still remain low and troublesome for many home buyers to find a home that meets their needs, that is affordable.

Recently, the 30-year fixed mortgage interest rates climbed back up to 7.5% in April and May which certainly didn’t help things.

Earlier this year the Federal Reserve changed their strategy and pumped the brakes on lowering rates because they saw an increase in leading indicators that inflation was rising again. This was done to avoid a repeat of the 1970s and early ‘80s when the U.S. economy experienced a double spike of inflation.

The new strategy was the Fed decided to hold things steady and not make any moves, and that has been the consensus the past few sessions. This likely played a role in the mortgage interest rates rising in April/May.

Home Builders Provide More Inventory and Smaller Homes

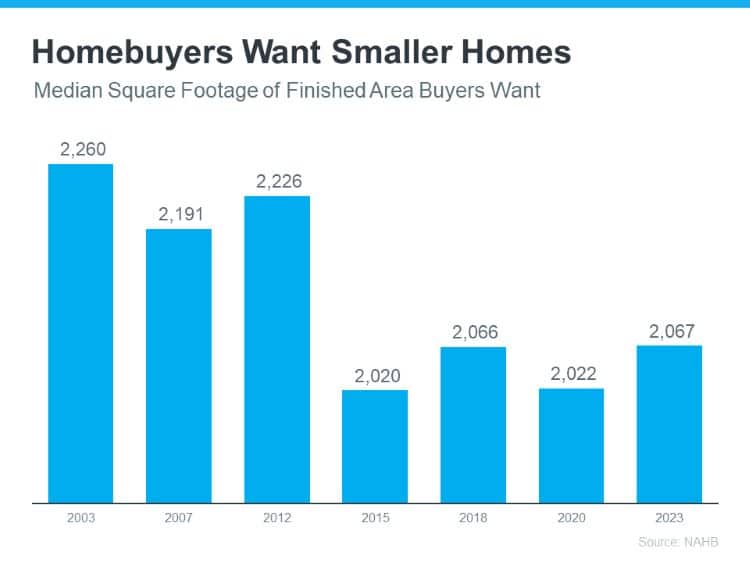

One solution home builders are providing in addition to increasing the availability of homes for sale is they are building smaller, more affordable homes. This is great news for first time home buyers who have really found it hard to find a home they can afford.

According to the National Association of Home Builders, homebuyers want smaller homes. In 2023, the median square footage of the finished area that home buyers wanted was 2,067 square feet. Clearly, the home building trend began back in 2015, but it has remained pretty consistent over the past 10 years.

“It’s [smaller sized homes] not solving the affordability crisis, but it is creating opportunities for people to be able to afford an entry level home in an area.” – Mikaela Arroyo, John Burns Consulting

Mortgage Interest Rate Ups and Downs

Buyers and sellers (and industry experts) really have no idea where the mortgage interest rates are going. Here are the quarterly estimates from industry leaders. It’s a roller coaster ride, and after a recent spell of interest rates up around 7.5% it has begun to come back down slightly.

“The biggest thing when we’re looking at mortgage rates right now is volatility,” says Nicole Bachaud, Senior Economist, Zillow.

We are in a volatile market when it comes to mortgage rates. And, it will take a little bit longer for mortgage rates to come down.

As we’ve discussed earlier, the Fed plays a role in mortgage interest rates. They rely on economic indicators to help determine whether to raise or lower rates, or keep them as is based on the indicators. The most impactful indicators include readings on labor market conditions, inflation pressures, and inflation expectations, and financial and international developments.

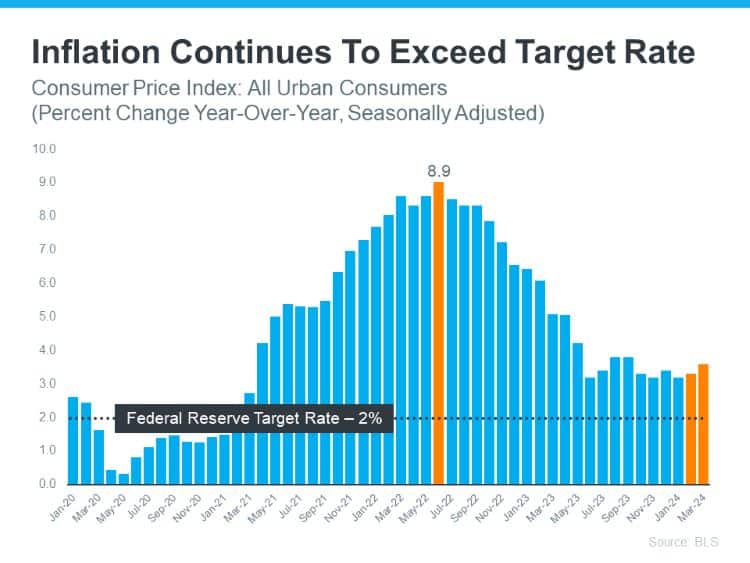

Inflation is still not where the Fed wants it.

Inflation is still not where the Fed wants it.

That said, we’re not where we were back in July of 2022 when inflation was up to 9%. But, the two orange bars for February and March 2024, that show inflation starting to go up again, caused the Fed to hold on dropping any rates because inflation came in higher than expected.

The Fed wants the Consumer Price Index for All Urban Consumers to be at 2%. The most recent report, ending April 2024, the all items index increased 3.4% before seasonally adjusted over the past 12 months.

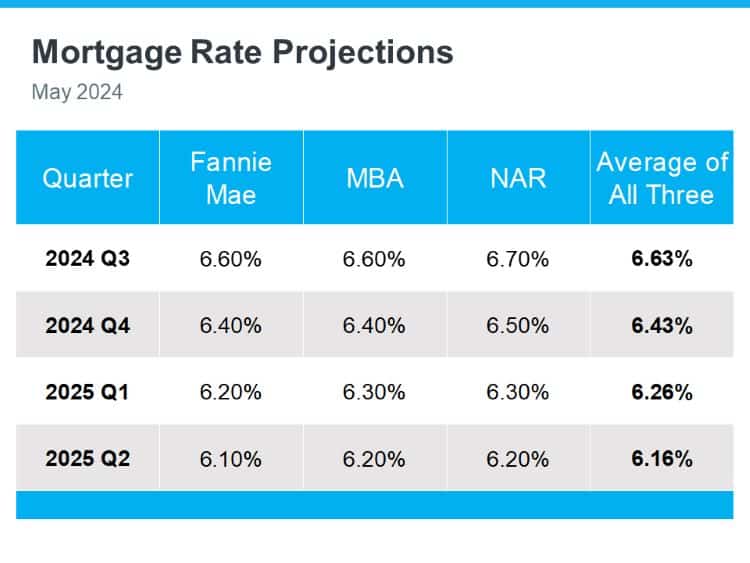

Even though things have been inconsistent with mortgage rates. Above are the estimated mortgage rate projections for the back half of 2024, and the first half of 2025, provided by three market leaders. And, as you can see headed into the summer months, these industry leaders are expecting the interest rates to reach 6.63% for Q3 2024.

Even though things have been inconsistent with mortgage rates. Above are the estimated mortgage rate projections for the back half of 2024, and the first half of 2025, provided by three market leaders. And, as you can see headed into the summer months, these industry leaders are expecting the interest rates to reach 6.63% for Q3 2024.

How Homebuyers can Compete in Sellers Market

In a competitive seller’s market, potential home buyers need to be proactive and strategic to increase their chances of having their offer accepted.

Here are some effective strategies buyers can attempt:

- Get Pre-Approved for a Mortgage – Homes for Heroes mortgage specialists are ready when you are. Simply sign up to speak with a member of our team to find out how we can best serve you. Having a pre-approval letter from a lender shows sellers that you are a serious and qualified buyer, which can give you an edge over other offers.

- Be Ready to Move Fast – In a hot market, desirable homes tend to sell fast. Be prepared to view listings as soon as they hit the market and submit offers promptly.

- Make a Strong Offer – Consider offering above the asking price, if within your budget. You can also make your offer more attractive by waiving certain contingencies (with caution), shortening inspection periods, flexible closing date, or offering a larger earnest money deposit.

- Offer Incentives – Propose incentives like paying some of the seller’s closing costs, providing a rent-back period after closing, or offering an appraisal gap coverage.

- Write a Personal Letter – A well-written letter to the seller highlighting your connection to the property or neighborhood could help your offer stand out.

- Be Open to Compromise – Remain open to compromising on wants vs. needs, and be willing to act quickly on homes that meet your key criteria.

Home Seller Strategies to Consider

In a competitive seller’s market, potential home buyers will be trying to outdo each other by using some of the tactics noted above to sweeten the deal.

It is best to consider the following strategies to make your home the most appealing and so you’re able to capitalize on getting the best price for your home:

- Make Your Home Show Ready – First impressions matter, so ensure your home looks good, smells good, and feels good before any showings. Declutter, depersonalize, and deep clean every room. If preferred, consider staging your home to highlight its best features.

- Price Your Home Reasonably – Setting the right price is one of the most important strategies in a competitive market. Overpricing can turn away potential buyers, while a fair and attractive price can generate more interest and multiple offers. Work with your real estate agent to analyze market trends and comparable home sales to determine the optimal price.

- Consider Incentives (if necessary) – Sometimes offering incentives can make your property stand out. Consider providing a home warranty, covering closing costs, or offering flexible move-in dates. These small gestures can create a win-win situation, attracting more buyers and possibly leading to a quicker sale.

Both home buyers and sellers should approach the market and the process with patience, and the willingness to be flexible when appropriate.

When the time comes to take action, be sure to work with licensed real estate and lending professionals who will get the job done with your best interests in mind, like how Homes for Heroes and our local real estate and mortgage specialists approach working with you.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. We refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of our team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.