Welcome to the Housing Market Trends May 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends May Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

- Despite the ongoing rise in home prices, strategic choices such as focusing on growing inventory areas for affordability and leveraging home equity can benefit both buyers and sellers in achieving competitive market positions.

- Fluctuating mortgage rates require vigilant monitoring and strategic timing for locking in rates.

- An increase in available inventory provided more options and less pressure for buyers, while sellers must differentiate their properties and adopt flexible strategies to attract interest in a competitive market.

- BONUS: Homes for Heroes offers resources and support to navigate these market trends, and provides an average savings of $3,000 after a hero buys or sells a home using their local specialists. Sign up today and a team member will contact you to discuss how to best serve your needs.

Home Pricing and Affordability

Home price increases continue as the National Association of REALTORS® states that home prices increased 4.8% in March 2024 vs. March 2023. That is the ninth consecutive month of year-over-year price gains, and the highest average home price ever for the month of March.

There are three primary factors that contribute to home affordability:

There are three primary factors that contribute to home affordability:

- Wages or household income

- Mortgage rates

- Home prices

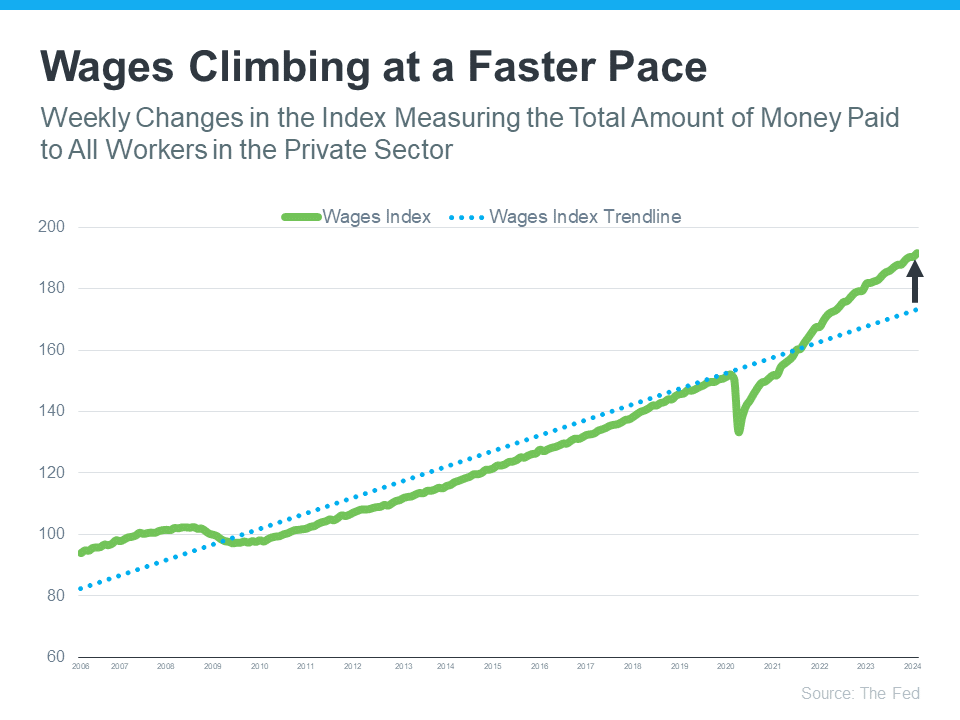

Right now, on average, wages are climbing at a faster pace than they have in the past.

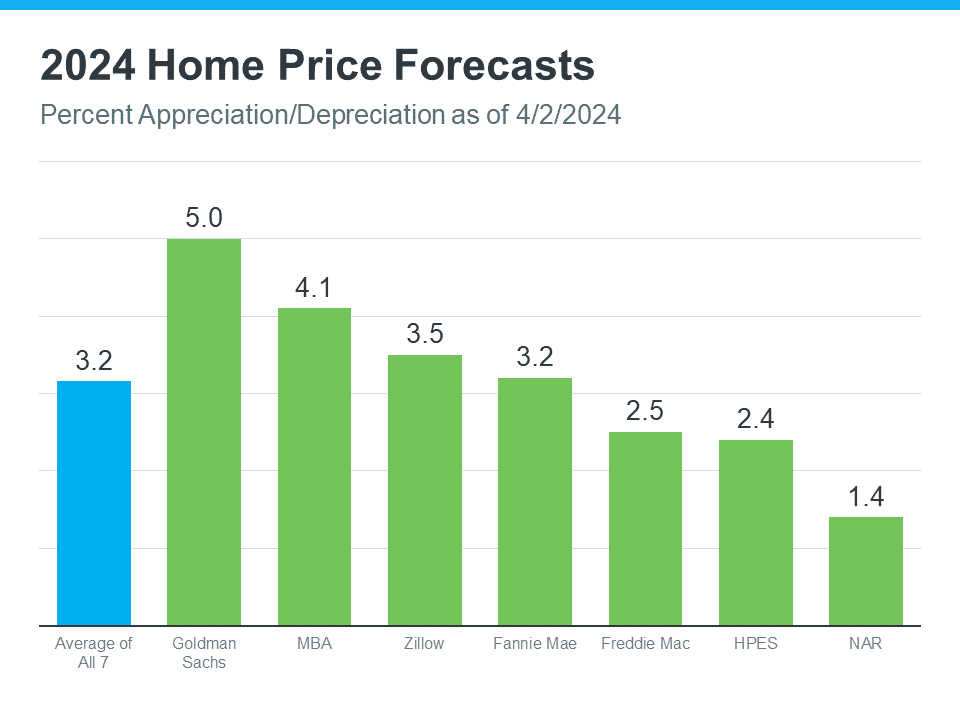

The 2024 home price percent appreciation forecast by seven industry leaders is an average of 3.2% increase in 2024.

The 2024 home price percent appreciation forecast by seven industry leaders is an average of 3.2% increase in 2024.

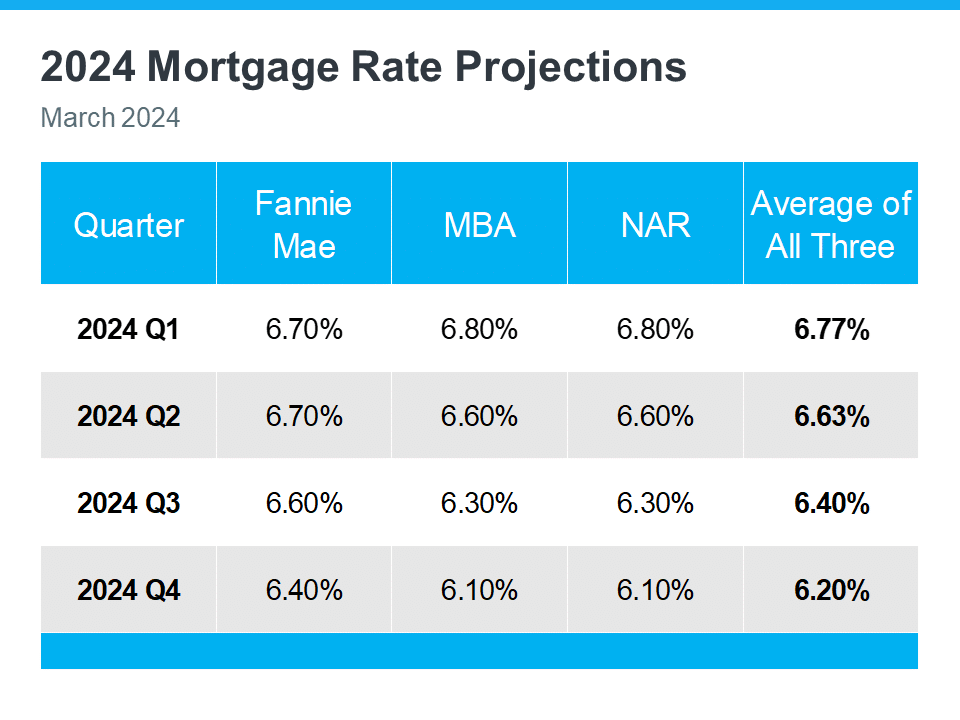

And, mortgage rates are a wildcard. We were watching rates drop in March and things were looking promising, only to have them increase again in April, especially over the past three weeks from April 11 – May 2, 2024.

And, mortgage rates are a wildcard. We were watching rates drop in March and things were looking promising, only to have them increase again in April, especially over the past three weeks from April 11 – May 2, 2024.

Home Affordability Recommendations for Buyers and Sellers

- First-Time Home Buyers – With home prices continuing to rise, though at a slower pace, affordability remains a key concern. Try to target areas where inventory appears to be increasing, as these areas may offer more opportunity for competitive pricing.

- Homeowners Looking to Buy – Leverage the equity from your current property to transition into your next home. High-equity positions offer a buffer that not all buyers can bring to the table. Consider properties in areas predicted to appreciate. Turn your likely high initial investment into a profitable long-term asset.

- Homeowners Looking to Sell – Set a competitive price for your home by understanding current local market conditions. Especially in a market where buyers have more options due to increased inventory.

Mortgage Interest Rates

Again, the Fed recently elected not to move on interest rates and instead hold their ground. Remember the Fed wants the Consumer Price Index down to 2%. Their last session offered no real timeline for an interest rate cut. However, many market experts are predicting it’s likely to happen between June and September.

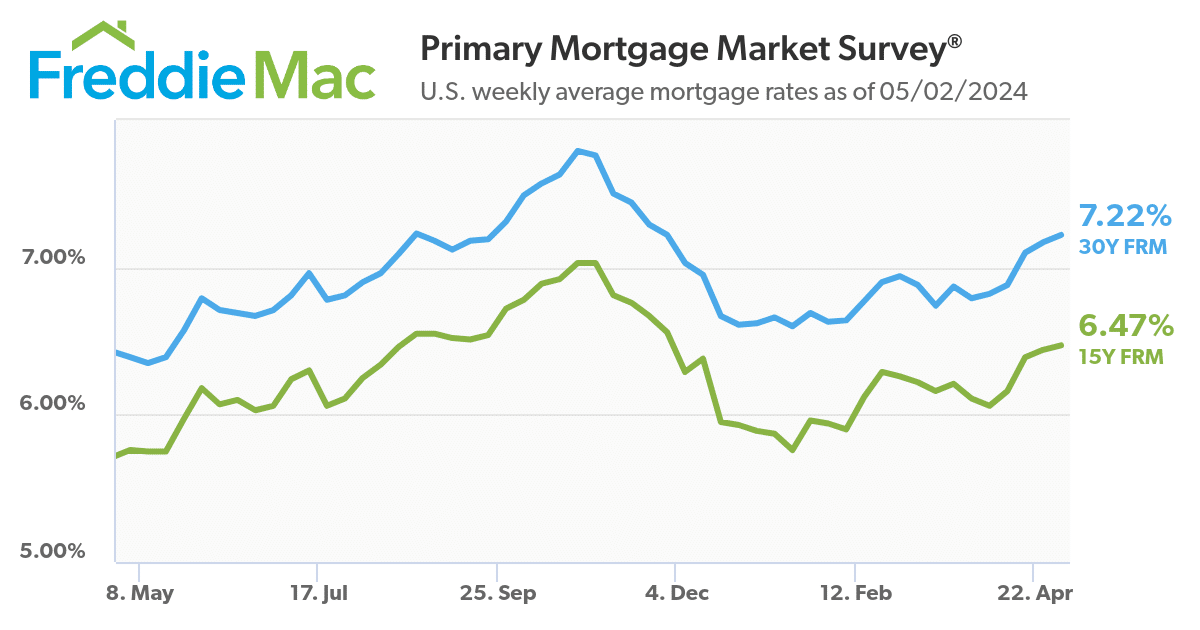

As of last week, posted on May 2, 2024 – FreddieMac’s Primary Mortgage Market Survey reflects the 30-year fixed rate mortgage at 7.22%, and the 15-year fixed rate mortgage at 6.47%.

Mortgage Rate Recommendations for Home Buyers

- First-Time Home Buyers – The fluctuating interest rates are tough right now. But there are things you can do to help yourself. Such as going through the pre-approval process so you’re all set to lock in a mortgage rate when you find the right home and mortgage rates are trending in the right direction. Being able to lock it in quickly can protect you from upward interest rate trends. And, be sure to give yourself a range of rates in your budget planning to maintain affordability in case interest rates do go up before you lock it in.

- Homeowners Looking to Buy – Monitor the interest rates closely as even a slight reduction can significantly affect your buying power and overall financial planning.

Home Inventory Available for Sale

Will inventory improve for the Spring housing market? According to Realtor.com, inventory of homes actively increased in 45 out of 50 of the largest metropolitan areas compared with last year.

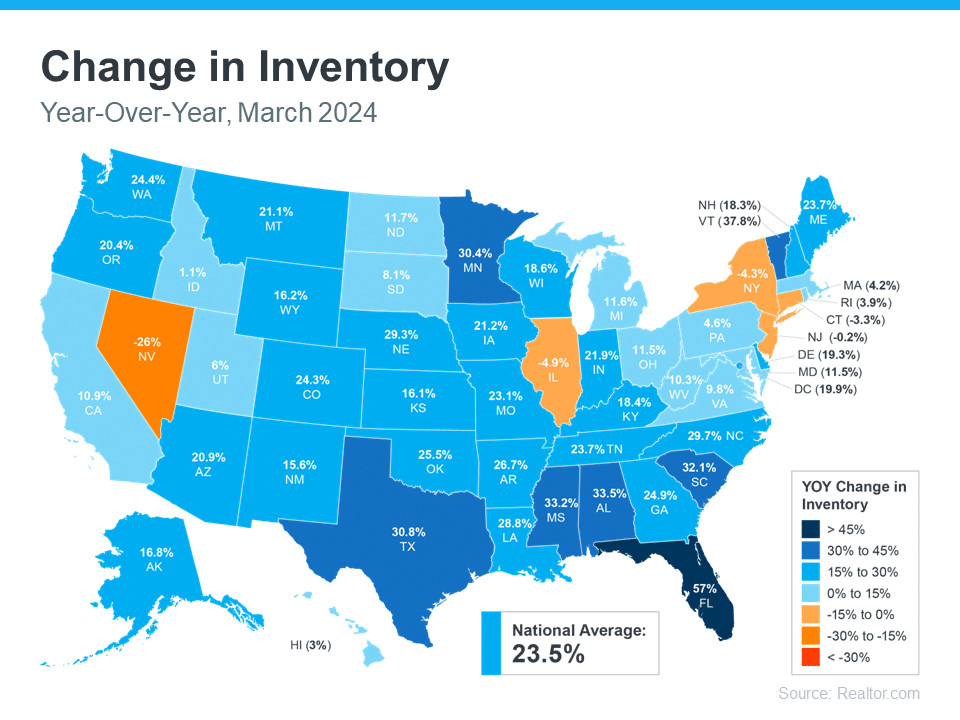

Year-over-year, March 2023 vs. March 2024, the national average change in home inventory has increased +23.5% since March 2023. Even though we have experienced this growth in inventory over the past year, according to Realtor.com:

“While inventory in March is much improved compared with the previous three years, it is still down 37.9% compared with typical 2017-2019 inventory levels,” – Source: Realtor.com

It also appears that homes priced in the range of $200,000 – $350,000 experienced the most growth versus other price categories. This is a helpful boost when it comes to home inventory, but also with homes that are more affordable.

Home Inventory Recommendations for Buyers and Sellers

- First-Time Home Buyers – Additional inventory provides you with more choices and may reduce the need for rapid, competitive bids. It may offer you additional time to make a more informed purchase decision, and provide you with better negotiating power.

- Homeowners Looking to Buy – An increase in inventory may present more opportunities to find a home that checks all your boxes. However, readiness to act remains key, as desirable properties may remain highly competitive and move quickly.

- Homeowners Looking to Sell – Enhancing your home’s appeal through upgrades or staging can make it stand out as inventory increases and the market gets more competitive. The seller market is still strong as inventory remains lower when compared to the 2017-2019 time frame, but if you are struggling, maybe consider more flexible selling strategies; such as offering to cover closing costs.

“Consumer attitudes toward home selling increased in February, with current homeowners, in particular, expressing greater optimism that it’s a ‘good time to sell.’” – Doug Duncan, Senior VP and Chief Economist at Fannie Mae

Conclusion

Understanding the complexities of today’s residential real estate market is essential for anyone looking to buy or sell a home. By staying informed about the latest trends in home pricing, mortgage rates, inventory, and overall market movements, you can make more strategic decisions that align with your financial goals and lifestyle needs. Whether you are entering the market for the first time, upgrading, or selling, there are opportunities and challenges to navigate. Remember, the key to success in real estate is not just in reacting to the market, but in anticipating changes and preparing accordingly. Equip yourself with knowledge, and you’ll be well on your way to making confident and successful real estate decisions.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. In addition, if you work with our local real estate and mortgage specialists to buy, sell or refinance; we also provide significant savings after working with our specialists to close on a home or mortgage. We refer to these savings as Hero Rewards®, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

LIST OF SOURCES:

https://www.realtor.com/research/data/

https://fred.stlouisfed.org/series/CES0500000017

https://www.goldmansachs.com/intelligence/pages/us-home-prices-forecast-to-climb-as-mortgage-rates-fall-in-2024.html

https://www.mba.org/news-and-research/forecasts-and-commentary/mortgage-finance-forecast-archives

https://www.zillow.com/research/2024-housing-predictions-33447/

https://www.fanniemae.com/media/50801/display

https://pulsenomics.com/surveys/

https://cdn.nar.realtor//sites/default/files/documents/forecast-q1-2024-us-economic-outlook-01-26-2024.pdf

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.