Welcome to the Housing Market Trends September 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends September Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends for August to help keep you informed as you determine what’s best for you.

- Mortgage Rate Trends – Mortgage rates have been dropping since August, and further reductions are possible depending on upcoming Federal Reserve decisions.

- Home Pricing Trends – Home prices are continuing to rise but are expected to increase at a slower rate in 2025.

- Home Inventory Trends – Inventory has slightly increased, but falling mortgage rates may reduce available homes as more buyers enter the market.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes, with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to learn more and a member of the team will contact you.

Housing Market Trends September 2024 in Detail

Mortgage Rate Trends

The next much anticipated meeting of the Federal Reserve is September 18th and many are predicting that the Fed will reduce the federal funds target rate. This is not an interest rate, but it is a factor used in determining mortgage interest rates.

Back on July 31st, the Fed held the federal funds target rate at 5.25%-5.50%. But, it was strongly stated that September there is a good chance rates will come down, depending on how inflation data cooperates until the Fed meets again on September 18th.

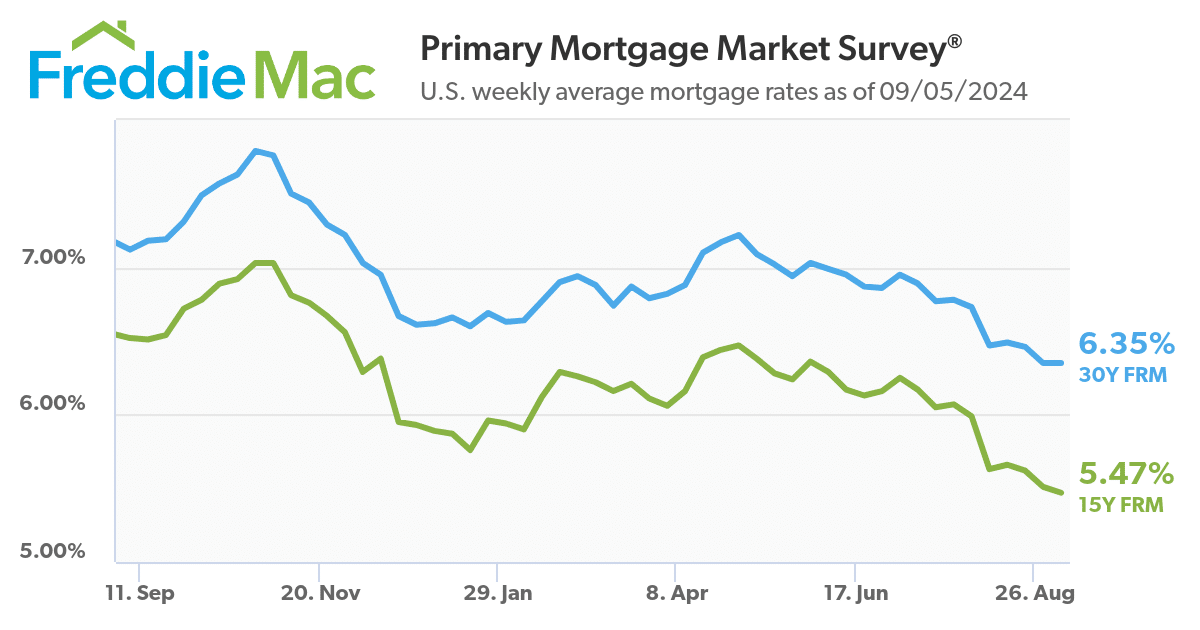

Since the Fed made that statement, the market responded positively and mortgage interest rates began to steadily drop throughout August. Freddie Mac’s Primary Mortgage Market Survey line graph above shows the decline, and as of September 5, 2024 the weekly 30-year fixed rate mortgage rate came in at 6.35% and the 15-year fixed rate mortgage landed at 5.47%.

This recent decline in mortgage interest rates has been welcomed news from potential home buyers, giving them more purchasing power in a market where home affordability has been a primary issue.

Here is a side by side comparison that shows a monthly mortgage payment estimate using the 30-year fixed rate on April 25, 2024 which was 7.52%, compared with the 30-year fixed rate on August 2, 2024 which was 6.40%. And, you can clearly see that the drop in interest rates since April in this example would save that home buyer over $375 per month (or 10.7% reduction) on their mortgage payment. That is a big difference and a welcomed change for home buyers.

Hopefully the rate reduction trend will continue and the Fed will receive improved inflation data that will prompt the Fed to reduce the federal funds target rate, which may potentially reduce mortgage rates even further for would-be home buyers beginning in September.

Home Pricing Trends

This downward trend in mortgage interest rates is likely to impact home prices. However, experts believe it may cause more stabilization of national home price increases, but it is not likely to cause national home price depreciation.

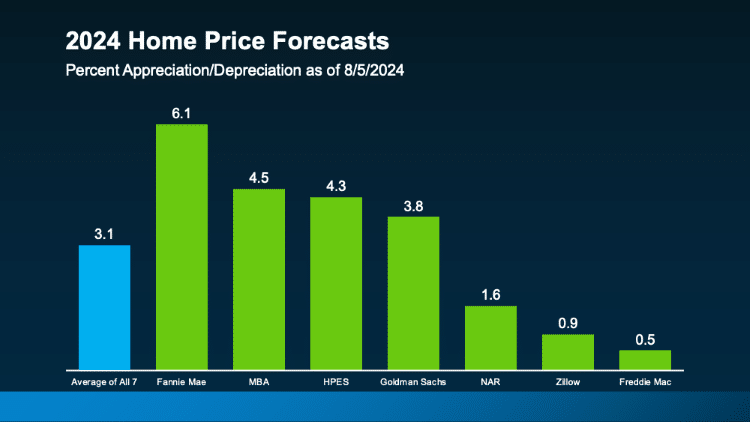

The National Association of Realtors (NAR) reported that national home prices increased 4.2% in July 2024, versus July 2023. And, that marks the 13th consecutive month of year-over-year national home price gains.

The bar graph above shows the 2024 national home price forecasts for seven industry leading resources, and their projected percent appreciation and/or depreciation of home prices as of August 5, 2024. As you can see it ranges from 0.5% – 6.1% increases depending upon the independent source, with an average of 3.1%.

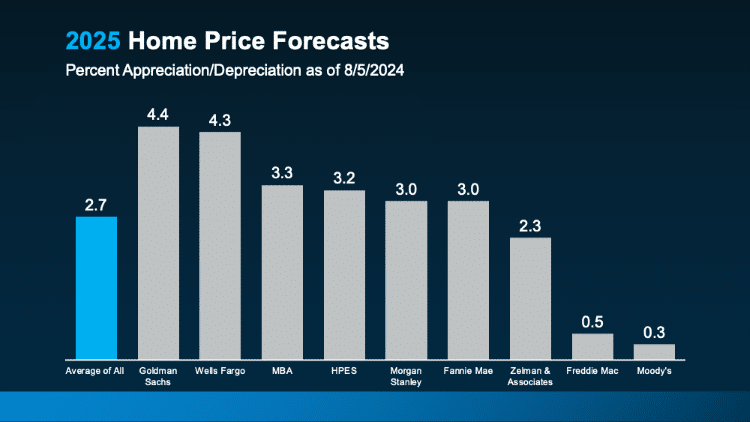

As of August 5, 2024 these are 2025 national home price forecasts from a different sub-set of eight leading resources. But, the bar graph shows a slight decrease in the level of home price appreciation in 2025 versus 2024. So, home prices are projected to still increase in 2025, to the average estimate of 2.7%. It’s a slightly lower rate appreciation than 2024, but national home prices are still likely to increase in 2025.

This is great news for homeowners worried about loss of recent equity gains for their current home, and also for would-be home sellers who want to capitalize on the recent price increase to leverage that gained equity for other financial priorities.

However, this is not great news for home buyers who are still struggling to find affordable housing options in today’s market, even with recent reductions in mortgage rates.

That said, it is good to know that leading market experts are expecting the rate of home price increases to slow a bit. That is better news than if the rate of increase were projected to be higher in 2025.

So, when it comes to national home prices specifically, now is the best time to buy a new home versus later, before the home price increases. Again, this is nationally, so be sure to understand your local market home pricing trends. Here are two reasons, based on national home price forecasts, why purchasing now versus later may be your best option:

- The home is likely more affordable now than it will be in one year based on market expert forecasts of further national home price appreciation in 2025.

- After you purchase the home, the home’s value is expected to increase in the next year, therefore giving you the home buyer more home equity in one year’s time.

If you’re deciding whether to enter the market to purchase a home and would like to better understand your current local market, sign up to speak with a member of the Homes for Heroes team. They will answer your initial questions, and when you’re ready, connect you with our local real estate and/or mortgage specialist to begin the process.

Speaking of Home Equity – Current Trends

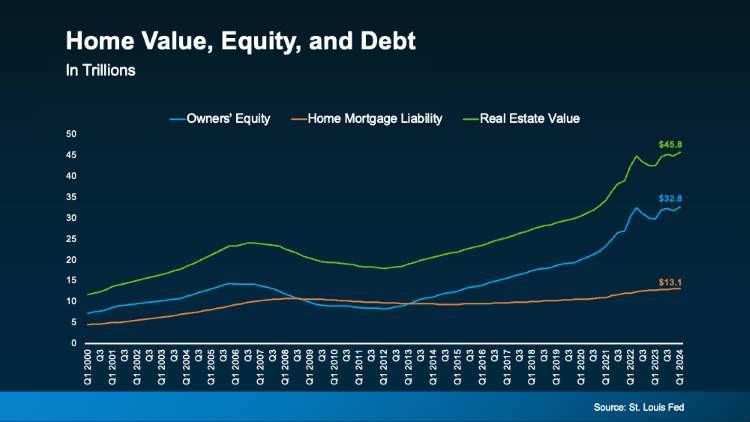

This trendline graph shows the amount of home value, equity and debt beginning in Q1 2000, through Q1 2024.

The amount of real estate value and home owner’s equity has grown exponentially in the past five years. Whereas home mortgage liability or debt has increased, but not nearly as dramatically. This graph clearly shows the recent impact of dramatic home price gains.

One thing to keep in mind is when a homeowner sells their home and receives gross capital gains more than $500,000 it may trigger an additional tax liability (for a married couple). This is something to be aware of as current homeowners who may be teetering on whether to sell their home.

The good thing is you have all that equity. But, there may be an added cost on that equity when you sell. If you find yourself in this potential situation, we recommend you speak with a qualified tax or financial advisor to better understand your situation.

Home Inventory Trends

Since our last monthly housing market report, generally speaking, inventory continued to improve. And as more inventory becomes available, more home buyers have more options, giving them a better chance of finding a home to purchase.

The National Association of Realtors (NAR) reported the inventory of unsold existing homes increased 0.8% in July 2024, versus the previous month of June.

Some experts believe the recent decrease in mortgage interest rates is likely helping home buyers find more affordable home purchasing options.

However, according to a recent Housingwire post on inventory levels, this may have caused a slight dip in home inventory the last week of August. This dip is counter to recent increases in inventory over the past few months.

So, if the interest rates continue to go down, more home buyers may get back into the market, and that could directly impact inventory levels. This is definitely something to watch, especially since the Fed may be considering moving the federal funds target rate by 0.5 vs 0.25 on September 18th.

Only time will tell, but we hope this report has given you more than you had before reading it.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. We refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

LIST OF SOURCES:

https://www.freddiemac.com/pmms

https://www.mortgagenewsdaily.com/mortgage-rates

https://www.mortgagecalculator.net/

https://www.fanniemae.com/media/52501/display

https://img03.en25.com/Web/MortgageBankersAssociation/%

7B60d4f010-5e1c-4c57-8ad5-4c884308c32c%7D_Mortgage_Finance_Forecast_Jul_2024.pdf

https://x.com/NewsLambert/status/1797659853403672983/photo/1

https://cdn.nar.realtor/sites/default/files/documents/forecast-q2-2024-us-economic-outlook-06-27-2024.pdf

https://www.zillow.com/research/home-value-sales-forecast-33822/

https://www.freddiemac.com/research/forecast/20240418-economic-growth-moderated-labor-market-robust

https://www.fastcompany.com/91152396/housing-market-outlook-for-2025-early-home-price-predictions

https://img03.en25.com/Web/MortgageBankersAssociation/%7B60d4f010-5e1c-4c57-8ad5-4c884308c32c%7D_Mortgage_Finance_Forecast_Jul_2024.pdf

https://www.fanniemae.com/media/52501/display

https://fred.stlouisfed.org/tags/series?t=real+estate

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.